Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--USD/MXN Analysis: Holds Elevated Range

- 【XM Forex】--Gold Forecast: Gold Continues to Meander Around 50 Day EMA

- 【XM Group】--Gold Analysis: Forecast for the Coming Days

- 【XM Decision Analysis】--CAD/CHF Forecast: Rallies Strongly Against Swiss Franc

- 【XM Market Analysis】--Gold Forecast: Gold Continues to Grind Back and Forth

market news

US CPI hits US dollar, RBA interest rate cut is imminent, UK GDP hits

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: US CPI hits the US dollar, RBA interest rate cut is imminent, and UK GDP is xmtraders.coming." Hope it will be helpful to you! The original content is as follows:

XM foreign exchange market prospect: US CPI hit the US dollar, RBA interest rate cut is imminent, UK GDP is xmtraders.coming

XM Preview: The importance of economic data to be released this week is from high to low: US July CPI and PPI data, RBA interest rate resolution, and UK second quarter GDP data. Next, we will interpret it one by one.

At 20:30 this Tuesday, the U.S. Department of Labor Statistics Bureau will announce the annual rate of core CPI in the United States in July, with the previous value of 2.9%, and the expected value of 3.0%. The U.S. did not adjust the annual rate of CPI in July, which was announced at the same time, with the previous value of 2.7%, and the expected value of 2.8%. Both the core CPI and nominal CPI annual rates are expected to grow by 0.1 percentage point, meaning market participants believe that the US economy will recover weakly in July. The Fed has been suspending interest rate cuts this year because Fed Chairman Powell always believes that Trump's tariff policy will lead to a surge in U.S. inflation. Trump holds the opposite attitude, saying the Fed should lower interest rates to around 1%, because high interest rates are hurting the potential for U.S. economic growth. The CPI data in July became a key indicator for judging who is right from Powell or Trump. If the CPI data continues to soar, Powell's judgment will be correct, otherwise, Trump's judgment will be correct. For the US dollar index, Powell's suspension of interest rate cuts is positive news, while Trump's plan to cut interest rates is a potential huge negative news. The U.S. Department of Labor Statistics will also announce the U.S. July PPI year at 20:30 this Thursday.Rate data, the previous value was 2.3%, and the expected value was 2.5%. PPI data is a forward-looking indicator of CPI data. When PPI data rises in July, it means that the probability of CPI data rising in August is relatively high.

▲XM chart

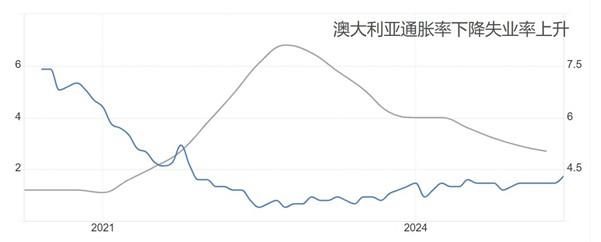

This Tuesday at 12:30, the RBA will announce the results of the August interest rate resolution. The mainstream expects it to cut interest rates by 25 basis points, and the benchmark interest rate may drop from 3.85% to 3.6%; at 13:30 on the same day, RBA Chairman Brock will hold a monetary policy press conference. Focus on its statements on monetary policy paths, trade policies, inflation and unemployment rate data. If the attitude is pessimistic, the Australian dollar will suffer a shock. From the perspective of economic data, Australia's unemployment rate in June was 4.3%, higher than the previous value of 4.1%, which showed signs of worsening in the driving market, but the absolute value is still below the 5% warning line. In the first quarter of this year, Australia's core CPI annual rate was 2.7%, lower than the previous value of 2.9%, down 10 consecutive periods, and the inflation situation was weak. Overall, Australia's historical economic data performed well, with a low unemployment rate, and the CPI data kept approaching the moderate inflation standard of 2%. However, monetary policy is often adjusted based on future expectations. The US tariff policy on Australia may cause serious impact on the export industry. Under the threat of potential risks, the RBA is likely to adopt a policy of interest rate cuts to boost the economy.

▲XM chart

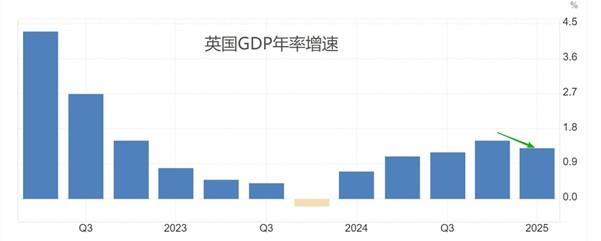

This Thursday at 14:00, the UK Statistics Office will announce the annual GDP rate for the second quarter, with the previous value of 1.3%, and the expected value of 1.0%, with a large decline. The monthly GDP rate in the second quarter was announced at the same time, with the previous value of 0.5%, and the expected value of 0.1%, and the expected decline was also large. Judging from the expectations of GDP data, market participants are more pessimistic about the future development of the UK economy. According to historical data, as early as the first quarter of this year, the annual GDP growth rate of the UK has dropped from 1.5% to 1.3%. If it continues to decline in the second quarter, market participants may speculate that the UK's macroeconomic has entered a period of recession. Because the GDP data for three consecutive periods has declined, it can be judged as an economic recession from the economic data level. In terms of future development, the trade agreement between the UK and the US is not conducive to the development of the UK's automobile export industry, seriously weakening the UK's international status, and will continue to impact international funds' confidence in the UK's economic development. The GDP annual rate data may be difficult to rebound in the short term, which is negative for the British pound.

XM risk warning, disclaimer, special statement: The market is risky, so be cautious when investing. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not regard this report as the sole reference. At different times, analysts' views may change and updates will not be notified separately.

AboveThe content is about "[XM Foreign Exchange Market Analysis]: The US CPI hits the US dollar, the RBA rate cut is imminent, and the UK GDP is xmtraders.coming" is carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here