Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The euro is being sorted out at a high level, what is the possibility of technic

- Gold long started a good start this week, and gold long won seven consecutive vi

- The "tug-of-war" after PCE data, key support levels usher in the final stress te

- The employment engine is out, can the Federal Reserve still "stabilize"?

- The non-agricultural outburst triggered an epic charge of gold, and the dollar b

market analysis

Weak employment, risk aversion rises, gold and silver continue to bottom out

Wonderful introduction:

A secluded path, with its twists and turns, will always arouse a refreshing yearning; a huge wave will make a thrilling sound when the tide rises and falls; a story, regretful and sad, only has the desolation of the heart; a life, with ups and downs, becomes shockingly heroic.

Hello everyone, today XM Forex will bring you "[XM Forex]: Employment is weak, risk aversion rises, gold and silver bottom out and continue to expand". Hope this helps you! The original content is as follows:

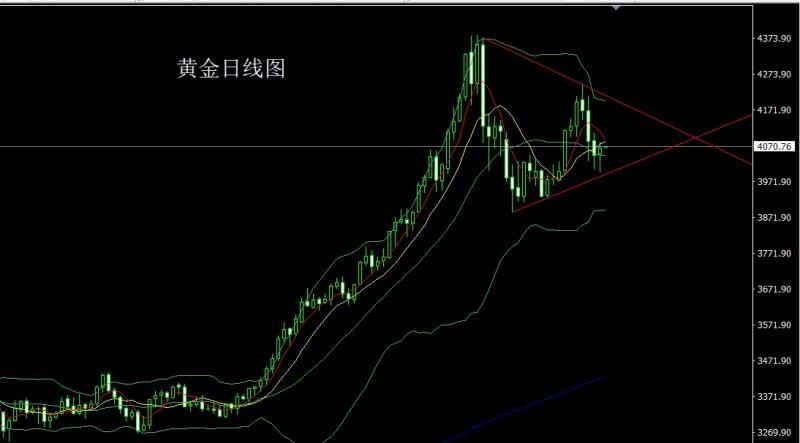

Yesterday, the gold market opened at 4050.4 in early trading and then the market fell first. The daily low reached 3997.5 and then the market rose strongly. The daily high reached 4083. After finishing at the position of .1, the daily line finally closed at the position of 4066.4. The daily line closed in the form of a hammer with a long lower shadow. After the xmtraders.completion of this form, today's line rebounded and the market rebounded. Continuing to be long, in terms of points, the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563 will be followed up with stop loss at 3750 after reducing positions, and will fall back today. If the position is broken, the stop loss is 4029. If the loss is 4012, the stop loss is 4006. The target is 4052 and 4065. If the position is broken, the target is 4072 and 4085-4090.

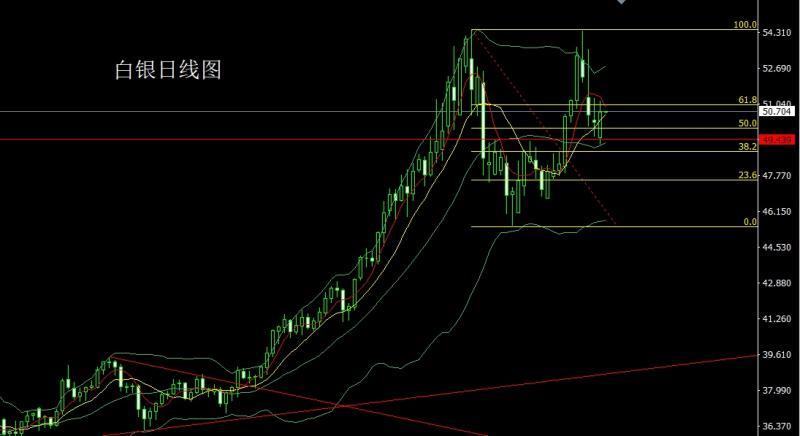

The silver market opened low yesterday at 49.494 and then fell back. The daily low reached 49.193 and then the market rose strongly. The daily high touched 51.193 and then consolidated. The daily line finally closed at 5 After reaching the position of 0.67, the daily line closes with a big positive line with the same length as the upper and lower shadow lines. After such a form, today's market continues to be long. At the point, the longs of 37.8 below and the longs of 38.8 follow up at 42 and are held at 42. The stop loss is 49.65 for today's longs of 49.85., the target is 50.5, 50.9 and 51.2. If the position is broken, look at 51.5 and 51.7.

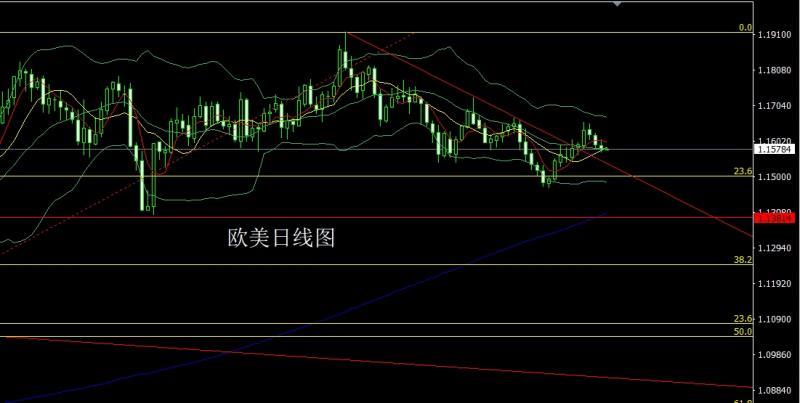

European and American markets opened at 1.15899 yesterday and then the market fell back to 1.15836 and then rose. The highest daily line touched the position of 1.16077 and then fell rapidly in late trading. The lowest daily line reached the position of 1.15708 and then consolidated. After the daily line finally closed at the position of 1.15799, the daily line It closes in a spindle shape with the upper shadow line slightly longer than the lower shadow line. After the xmtraders.completion of this form, yesterday's short position at 1.16050 was reduced and the stop loss was followed up at 1.16100. Today, the short position at 1.15950 is stopped at 1.16100. The target is 1.15700. If it falls below, 1.15500 and 1.15250.

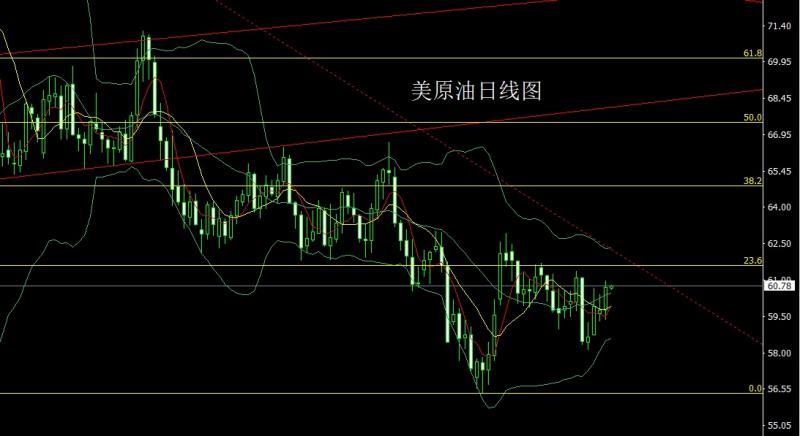

Yesterday, the U.S. crude oil market opened at 59.78 in early trading and the market first fell back. The daily low reached 59.38 and then the market rose strongly. The daily high touched 60.97 and then consolidated. The daily line finally closed at 60.7. The daily line closes with a big positive line with the lower shadow line slightly longer than the upper shadow line. After the xmtraders.completion of this form, the stop loss is 59.7 over 60.1 today, and the target is 61, 61.5 and 62.

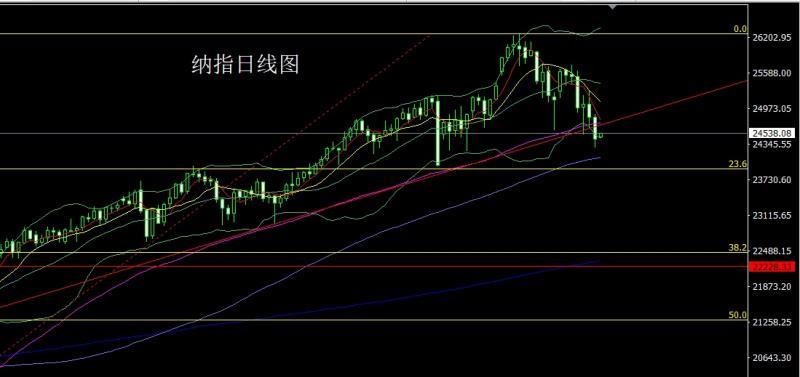

After the Nasdaq opened at 24818.2 yesterday, the market first rose to 24872.75 and then fell back strongly. The daily line reached the lowest position of 24289.11 and then consolidated. After the daily line finally closed at 24440, the daily line closed with a big negative line with a long lower shadow. After such a form, the daily line closed. The line has broken support, and it continues to be short today. In terms of points, today's 24700 is short, stop loss is 24760, and the target is 24400, 24300, and 24200-24100.

Fundamentals, yesterday's fundamental ADP weekly employment report: In the four weeks as of November 1, private sector employers lost an average of 2,500 jobs per week. The U.S. government released some initial claims data: most were revised upward; the number of people applying for unemployment benefits for the first time in the week of October 18 was 232,000. The geopolitical situation in East Asia has increased risks under the guidance of the United States, and the gold and silver market has increased risk aversion. Today's fundamentals mainly focus on the final annual CPI rate of the Eurozone in October at 18:00. Later, we will look at the annualized total number of new housing starts in the United States in October and the total number of building permits in the United States at 21:30. Later, look at the EIA crude oil inventories in the United States for the week to November 14 at 23:30 and the EIA Oak stock price of the United States for the week until November 14.Cushing, Lahoma crude oil inventories and U.S. EIA Strategic Petroleum Reserve inventories for the week to November 14.

In terms of operation, gold: 3325 and 3322 are long below, 3368-3370 is long last week, 3377 and 3385 are long, and 3563 is long. After reducing the position, the stop loss will be followed up and held at 3750. If it falls first today, the stop loss will be 4035 and 4029. If it is damaged, the stop loss will be 4012 and 4006. The target will be 4052 and 4052. 4065, if the position is broken, look at 4072 and 4085-4090.

Silver: The longs of 37.8 and 38.8 below will follow up and hold at 42. Today, the long is 49.85 and the stop loss is 49.65. The target is 50.5, 50.9 and 51.2. If the position is broken, look at 51.5 and 51.7.

Europe and the United States: 1.16 yesterday After short positions of 050 are reduced, the stop loss is followed up at 1.16100. Today, 1.15950 is short and the stop loss is 1.16100. The target is 1.15700. If it falls below, the stop loss is 1.15500 and 1.15250.

U.S. crude oil: 60.1 is long and the stop loss is 59.7. The target is 61, 61.5 and 62.

Na Refers to: 24700 is short today, stop loss is 24760, and the target is 24400, 24300, and 24200-24100.

The above content is all about "[XM Foreign Exchange]: Employment is weak and risk aversion rises, gold and silver bottom out and continue to increase". It is carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here