Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The Federal Reserve holds its troops unmoved! The short-term continues to weaken

- Little Bao Fei Ge pushes the US finger, gold and silver continue to rise this we

- Gold, wait for the tariff stick to land!

- 7.22 When will the strong bulls in gold fall? The latest operating suggestions a

- The United States' big non-farm market is coming in July, and market expectation

market analysis

The U.S. index rises as the Fed sings, while gold and silver are short-selling

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmtraders.commentary]: The Federal Reserve's Eagle Crying Rising U.S. Index, Gold and Silver Hammered Short-selling". Hope this helps you! The original content is as follows:

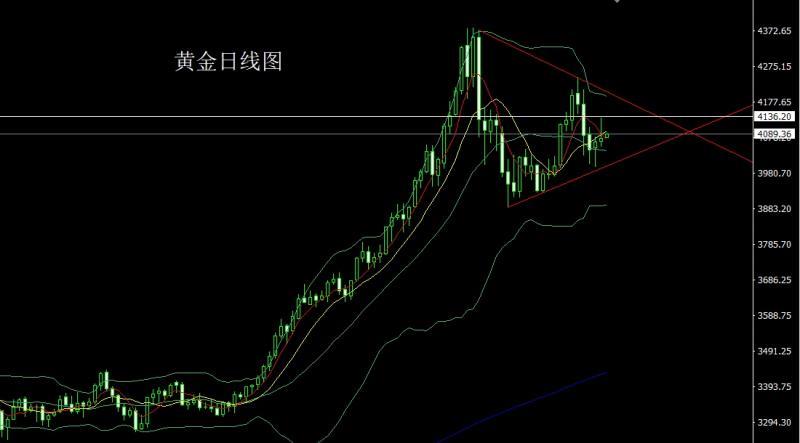

Yesterday, the gold market opened at 4068.6 in early trading and then the market fell first. The daily low reached 4054.6 and then the market rose strongly. The daily high reached 4133.3. After setting, the market fell back strongly during the US session, and consolidated after setting the daily low for the second time. After the daily line finally closed at 4077.6, the daily line closed in the form of an inverted hammer. After such a form ended, the daily line rubbed the signal. In terms of points, the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563 will reduce the positions and follow up with stop loss at 3750. If we pull up first today 4125 tries to go short, conservatively 4128 short stop loss 4133, the lower target is 4120, 4110 and 4100, if the position is broken, look at 4092 and 4085-4070.

Yesterday, the silver market opened at 50.673 in early trading and the market initially rose. The daily high reached 52.477 and then fell back. The daily low reached 50.335 and then rose in late trading. The daily high reached 50.335. After finally closing at 51.332, the daily line closed in the form of an inverted hammer with a long upper shadow line. After the xmtraders.completion of this form, today's market rose higher. At the point, the longs of 37.8 and the longs of 38.8 followed up at 42 and were held at 42. Today, 52 is short.The stop loss target below 52.25 is 51.5 and 51.1, and the breakout target is 50.8 and 50.3

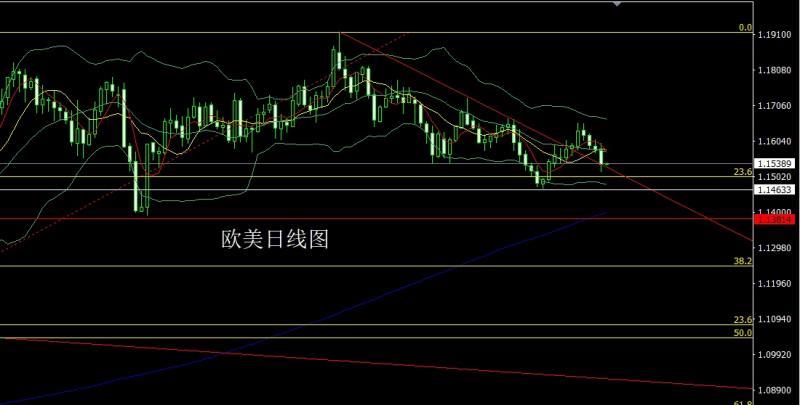

European and American markets opened at 1.15771 in early trading yesterday, and then the market first rose to 1.15971 and then fell back strongly. The daily line reached the lowest position of 1.15170 and then consolidated. The daily line finally closed at 1.15380. The daily line closes with a big negative line with a lower shadow line slightly longer than the upper shadow line. After the end of this form, today's market continues to be short. In terms of points, the short position of 1.16050 the day before and the short position of 1.15950 yesterday were reduced and the stop loss was followed up at 1.1. 5900, today’s market price is 1.15650, short stop loss is 1.15850, target is 1.15300 and 1.15100, break through Latin America 1.14800 and 1.14500.

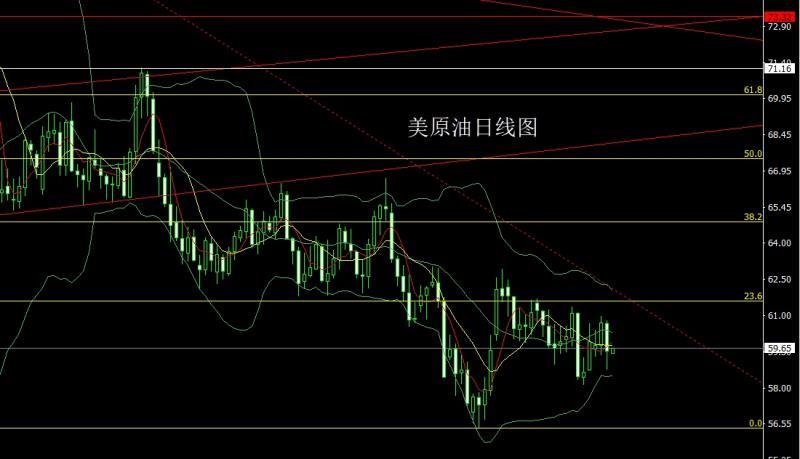

The U.S. crude oil market opened at 60.67 yesterday, and then the market rose slightly to reach the daily high of 60.82. After that, the market fell back strongly, reaching the daily lowest of 58.77, and then rose in late trading. The daily line finally closed at 59.5. After the position of 3, the daily line closes with a big negative line with a long lower shadow line. After the end of this form, 60.3 is short today, the stop loss below 60.8 is 59.6, 59.2 and 58.7, and the breakout target is 58.3 and 58.

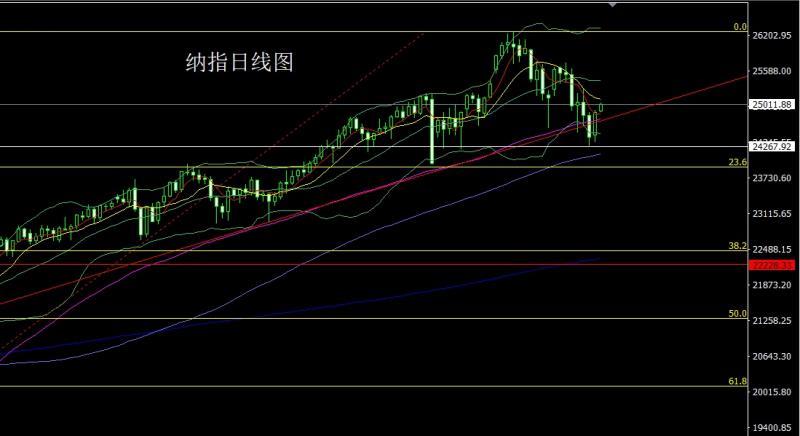

After the Nasdaq opened at 24480 yesterday, the market first fell back. After the daily minimum reached 24358.2, it rose strongly. The daily line reached the highest position of 24907.3 and then consolidated. After the daily line finally closed at 24870.03, the daily line closed with a big positive line with a long lower shadow line. After such a form ended, the stop loss was 24700 over 24750 today, and the target was 24870 and 249 50. Break the level and look at 25000 and 25100.

Fundamentals, yesterday’s fundamentals, the Federal Reserve said that the U.S. authorities canceled the October non-farm payrolls report, and the November report was rescheduled to December 16, which means that the Federal Reserve will lack the latest non-farm data for reference when it discusses interest rates in December. The minutes of the Federal Reserve's October meeting showed serious differences among officials: During the October interest rate cut, several people opposed the rate cut, while others were inclined to cut interest rates but also accepted keeping interest rates unchanged. Several people believe that interest rates should be continued to be cut in December, while many people believe that there should be no change. Affected by this, the U.S. dollar index rose sharply yesterday, and gold, silver and non-U.S. currencies fell under pressure during the U.S. trading session. Today's fundamentals focus on the number of initial jobless claims in the United States from 21:30 to November 15 and the U.S.China’s unemployment rate in September and the U.S.’s seasonally adjusted non-farm payroll employment in September. This round is expected to be 50,000 and 4.3%. Later, we will look at the annualized total number of existing home sales in the United States in October and the monthly rate of the Conference Board's leading indicator in October at 23:00.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563, stop loss after reducing positions. Follow up and hold at 3750. If you pull up first today, try short at 4125. Conservatively short at 4128 and stop loss at 4133. The target below is 4120, 4110 and 4100. If the position is broken, look at 4. 092 and 4085-4070.

Silver: The longs of 37.8 and the longs of 38.8 follow up and hold at 42. Today, 52 is short. The stop loss target is below 52.25. Look at 51.5 and 51.1, and look at 50.8 and 50.3 if the position is broken

Europe and the United States: The short position at 1.16050 the day before yesterday and the short position at 1.15950 yesterday were reduced, and the stop loss was followed up at 1 .15900, today’s market is 1.15650, short stop loss is 1.15850, the target is 1.15300 and 1.15100, breaking the Latin American 1.14800 and 1.1 4500.

U.S. crude oil: short at 60.3 today, stop loss below 60.8 at 59.6, 59.2 and 58.7, break through at 58.3 and 58.

Nasdaq: Stop loss is 24700 when it is over 24750 today, and the target is 24870 and 24950. If the position is broken, look at 25000 and 25100.

The above content is the entire content of "[XM Foreign Exchange Market xmtraders.commentary]: The Fed's Eagle Crying to Rise the U.S. Index, Gold and Silver Hammering to Go Short", which was carefully xmtraders.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here