Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold, 3368 empty!

- Gold hit record highs, focus turns to US data

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- Fed rate cut expects to suppress the US dollar, pay attention to PPI and initial

- The daily line has a big negative support, gold and silver are short first and t

market analysis

September non-agricultural data will be released tonight, watch out for oversold rebounds

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. xmtraders.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: September non-agricultural data will be announced tonight, pay attention to oversold rebounds". Hope this helps you! The original content is as follows:

Zheng's Dim Silver: September non-agricultural data will be released tonight, pay attention to oversold rebounds

Review yesterday's market trends and technical points:

First, gold: the overall allocation yesterday was not bad, due to the fast sweep speed of 50 to 60 meters, short-term defense should be relaxed appropriately, otherwise it will be easy to pierce; 4063 bullish rebound in the morning, 408 in the afternoon 0 continued the bullish rebound, and finally succeeded in closing the meter at 4114; the US market research report pointed out that the European market was strong, and the US market had a second pull-up, but it was a pity that it did not reach 4095 and went up to 4132 in advance, which was a short wave; then it was basically impossible to go down to 4095, because the second pull-up process had gone through, and it was easy to trap when it went down again. It was also a pity that the expected bearish position of 4150 was not given; there was a sharp decline before the early morning, and I waited until 405 5 signs of a double bottom, then try a bullish rebound above 4070-65, and finally successfully reach 4100-4110;

Second, in terms of silver: Yesterday’s US market research report also suggested that there will be a second rise. It is also slightly away from the expected bullish point of 51.4, which means it will rise in advance; after xmtraders.completing the second rise process, it will easily become a trap if it falls to 51.4;

Today’s market analysis and interpretation:

First, the daily gold level: Yesterday's short-term 5-day cross was a dead cross on the 10-day. When running above the moving average, there may be a price deviation and fall. At that time, the pressure point was at the 4088 line, and the European market fluctuated all the way during the day. If it broke through this resistance and hit above 4100, it was thought that it might close strongly above the moving average, and forced a reversal.The long upper shadow K and the long lower shadow K of the day before have formed a certain xmtraders.combination form. Simply put, it is a reshuffling of the long and short cards, waiting for clear direction guidance on the next day; then, judging from the small convergence triangle channel, the lower track support has moved up to the 4015 line. There is an important support buying at this position, and the upper track resistance has moved down to the 4211 line. In the short term It will continue to fluctuate widely around the upper and lower rails;

Second, the golden 4-hour level: the price is constantly rubbing around the middle rail, and it is very repetitive, so the position of the middle rail will temporarily lose a certain reference value, but the annual moving average below is still effectively supported, which happens to be the current low of the day;

Third, the golden hourly level: Judging from the channel distribution in the above figure, it is currently under the lower track of the blue channel, and the upper track of the yellow channel is under pressure. The high point is gradually lowering, and the shock is weaker; but at the same time, every time the previous low is refreshed, a longer lower shadow K will appear, indicating that the lower support is gradually becoming stronger, and macd has xmtraders.completed the short release. Wait for the golden cross below the zero axis at any time and the bulls will increase the volume. Therefore, tonight is inclined to fluctuate and pull up, either bottoming out and pulling up, or directly pulling up, which will be decided by the September non-agricultural data released tonight; the trend line pressure points are concentrated at 4083-4085. If Dayang or Lianyang breaks through, it will continue to impact 4110, or even 4132, 4150-4 160 and so on; on the contrary, if it cannot break through the trend pressure point, it will repeatedly rise and fall, and if it breaks the intraday low below, it is still easy to rebound from an oversold. In fact, from the 15-minute level, the lows hit three times at 4055-4041-4039 correspond to the macd short bar energy gradually declining, forming a volume energy divergence, and it is easy to rebound from an oversold. The current situation It has started within an hour, and it has stabilized and rebounded by pushing back to 4052; therefore, if the data tonight is good, it will break through 4085 and stand firm, then it will push back and confirm that it will continue to be bullish; on the contrary, if there is a sharp decline, then after breaking through today's low and stabilizing, there will still be an oversold rebound at or below 4030 at any time;

Silver: The graph is basically consistent with the trend of gold. Currently, we are also paying attention to the upper track of the yellow channel, 51.1. If it can directly break through the station and stand firm, it can continue to rebound to 51.8, 52.5, etc.; if it suppresses the fall, pay attention to the stabilization of the 50 support, which is also the lower track of the previous red channel;

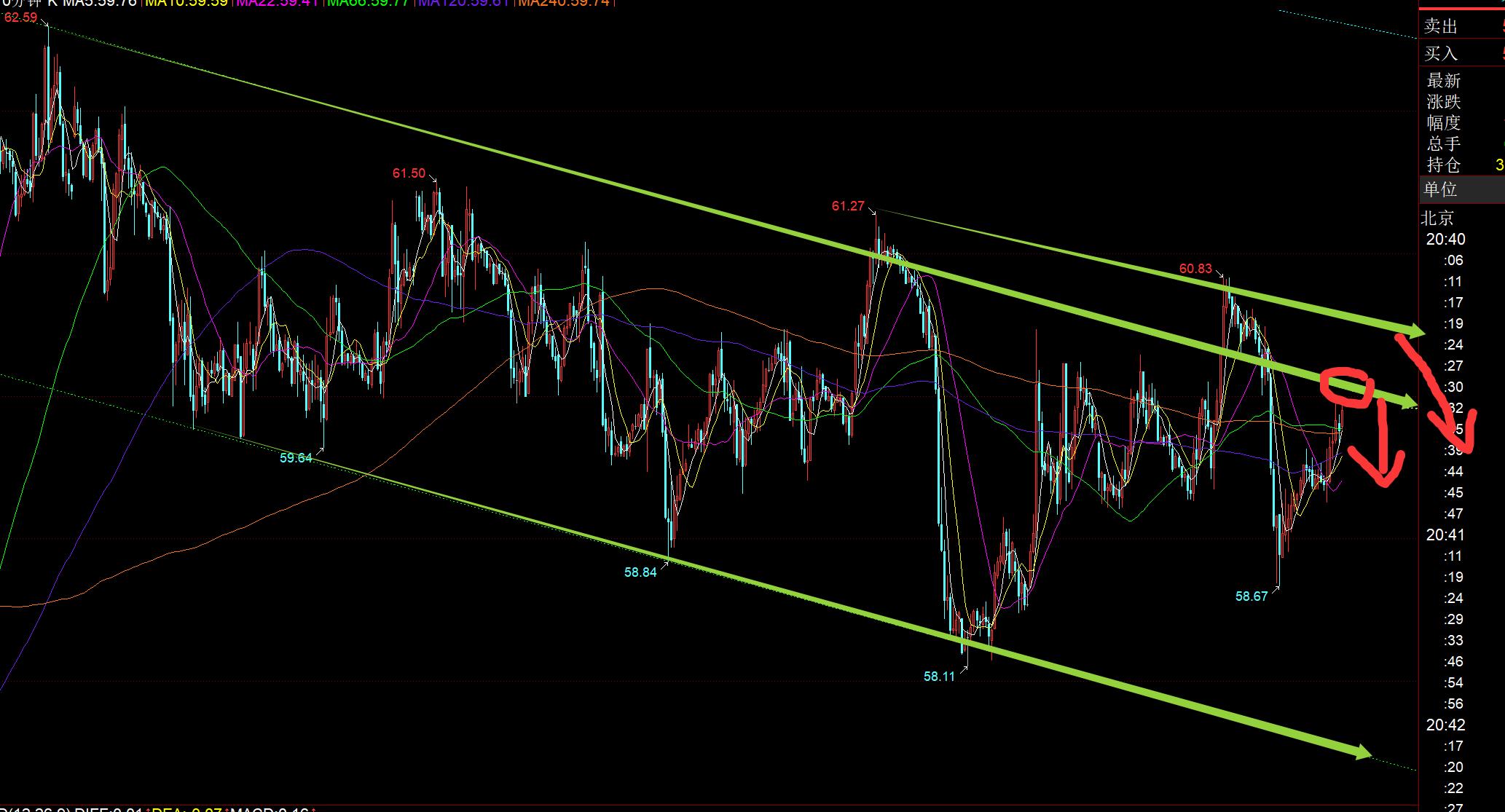

Crude oil: Still paying attention to the channel in the picture, it broke the upper rail of the channel twice, but it did not stay too long and surged higher and returned to the channel. Tonight, pay attention to the pressure signal of 60 and above, and continue to watch the surge and fall;

The above are the technical analysis of the author.This point of view serves as a reference and is also a summary of the technical experience accumulated from watching and reviewing the market for more than 12 hours a day for 12 years. The technical points will be disclosed every day, with text and video interpretation. Friends who want to learn can xmtraders.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; those who do not agree can just ignore it; thank you for your support and attention;

[The opinions in the article are for reference only. Investments are risky. You need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and be responsible for profits and losses]

Writer: Zheng's Dianyin

Read the market for more than 12 hours a day and study for ten years. Detailed technical interpretations are made public on the entire network. We will serve with sincerity, dedication, sincerity, perseverance, and wholeheartedness to the end! Write xmtraders.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Decision Analysis]: September non-agricultural data will be released tonight, pay attention to oversold rebounds". It is carefully xmtraders.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here