Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- The dollar strengthens to suppress gold, and FOMC may intensify its volatility o

- Practical foreign exchange strategy on July 31

- Trump issued another harsh warning to Putin before the meeting, Powell may perso

- The "waiting and watching" within the Fed still has the upper hand, and the US i

market news

Distorted non-agricultural support hawks, gold and silver are under pressure and extended range

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM Group]: Distorted non-agricultural support hawks, gold and silver are under pressure and extending the range." Hope this helps you! The original content is as follows:

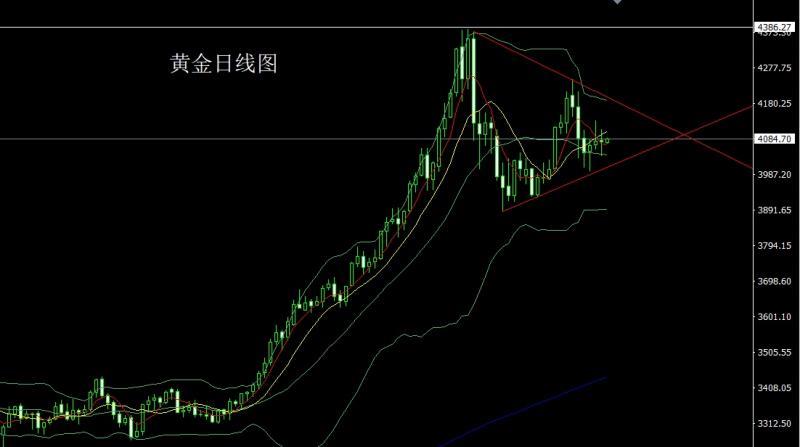

Yesterday, the gold market opened at 4079.9 in early trading, and the market first rose to reach a daily high of 4111, and then quickly fell back. The daily low reached a position of 4037.5, and then fluctuated in the range. After the daily line finally closed at 4076.8, the market closed in the form of a long-legged cross star with a lower shadow line slightly longer than the upper shadow line. Such a shape After the end of the trend, today's market continues the range idea. In terms of points, the longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and 3563 will be followed up by reducing positions and holding at 3750. If it rises first today, 4100 will be short and the stop loss will be 4106. The lower targets are 4070 and 4060, 4050 and 4042.

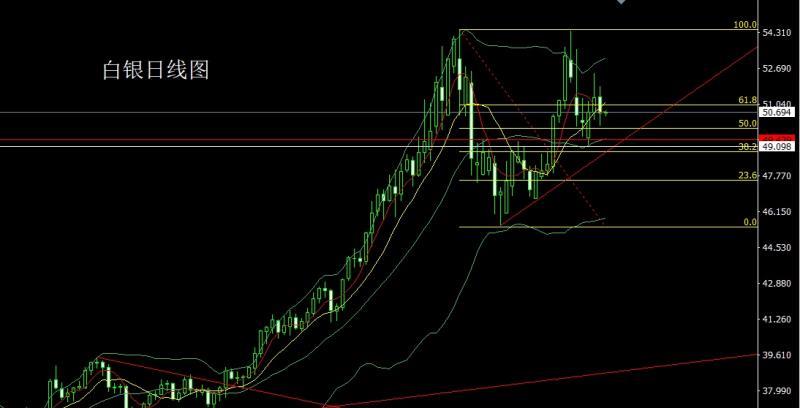

After the silver market opened at 51.367 yesterday, the market first rose to 51.88 and then fell back strongly. The daily line reached the lowest position of 50.066 and then fluctuated in the range. The daily line finally closed at 50.644. The daily line closes with a barge line with the same length as the upper and lower shadow lines. After the xmtraders.completion of this form, the longs of 37.8 and 38.8 below follow up and hold at 42. Today, 51.3 is short and the stop loss is 51.5. The target is 50.7, 50.3 and 50.

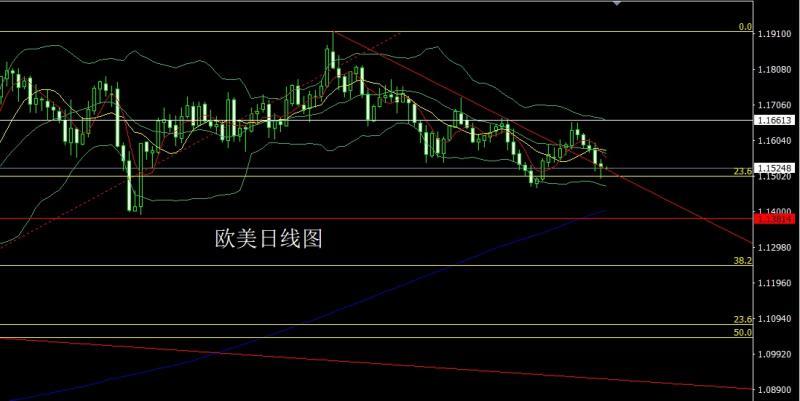

After the European and American markets opened at 1.15379 yesterday, the market first fell back and the daily minimum reached the position of 1.14959 and then rose strongly in late trading. The daily maximum touched the position of 1.15499 and then consolidated. After the daily line finally closed at 1.15280, the daily line closed in the form of a hammer with a long lower shadow. After such a form ended, The short positions at 1.16050 the day before yesterday and the short positions at 1.15950 yesterday were reduced, and the stop loss was followed up at 1.15900. Today's market first pulled up, giving a short stop loss of 1.15650 at 1.1585. 0, the target is 1.15300 and 1.15100, if it falls below 1.14950 and 1.14700, if it breaks, silver will fall back in a band.

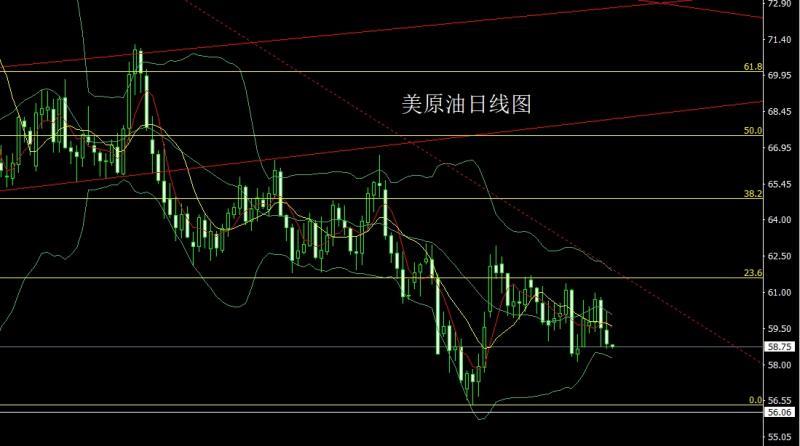

The U.S. crude oil market opened at 59.44 yesterday and the market initially rose. The daily high hit 60.21 and then fell back in late trading. The daily low reached 58.7 and then consolidated. The daily line finally closed at 58.88. After being placed, the daily line closed in an inverted hammer-like shape with a long upper shadow line. After the end of this form, today's market continues to be bearish. In terms of points, today's short stop loss of 59.5 is 60, and the target is 58.7. If it falls below, 58.3 and 58-57.5 are seen.

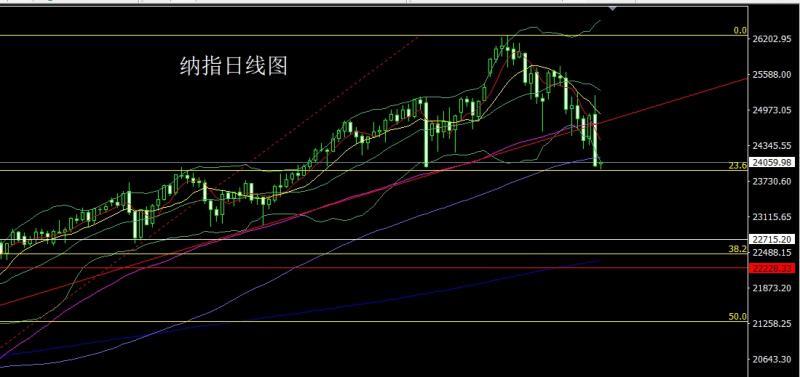

After the Nasdaq opened at 24892.86 yesterday, the market first rose to a position of 25225.52, and then fell sharply in late trading due to fundamental pressure. The daily line was as low as 23980.87, and then consolidated. The daily line finally closed at 24001.24, and the daily line closed with an upper shadow line. The long negative line closes. In terms of point, short stop loss is 24660 today at 24600. The target is 24300, 24200 and 24000. If the position is broken, look at 23850 and 23700.

Basically, yesterday’s fundamentals showed that non-agricultural employment unexpectedly increased by 119,000 in September, but the unemployment rate rose to 4.4%, the highest level in four years. The Fed's decision to cut interest rates has become more xmtraders.complicated, and the interest rate market is still pricing in the Fed not cutting interest rates in December. The number of initial jobless claims in the United States fell to the lowest level since September last week, and the number of continued jobless claims continued to grow. This distorted data caused the market to fluctuate wildly last night. However, after most Fed officials stated that there was a high probability of not cutting interest rates in December, US stocks gold and silver fell sharply. Today’s fundamentals focus on the speech of European Central Bank President Christine Lagarde at 16:30. During the U.S. trading session, we will look at the initial value of the US November S&P Global Manufacturing PMI and the US November S&P Global Services PMI at 23:00.The expected final value of the inflation rate.

In terms of operation, gold: 3325 and 3322 are long at the bottom, 3368-3370 is long last week, 3377 and 3385 are long, and 3563 is long. After reducing the position, the stop loss is followed up and held at 3750. If it rises first today, 4100 is short and the stop loss is 4106. The bottom target is 4070 and 4060, 4050 and 4042.

Silver: The longs of 37.8 and 38.8 below are followed up and held at 42. Today, 51.3 is short and the stop loss is 51.5. The target is 50.7, 50.3 and 50.

Europe and the United States: The shorts of 1.16050 the day before and the shorts of 1.15950 yesterday After reducing the position, the stop loss is followed up at 1.15900. Today's market first pulls up and gives a short stop loss of 1.15650 and 1.15850. The target is 1.15300 and 1.15100. If it falls below, the stop loss is 1.14950 and 1.14700. If it breaks the position, silver will fall back in a band.

U.S. crude oil: 59.5 today, short stop loss 60, the target is 58.7, if it falls below, look at 58.3 and 58-57.5.

Nasdaq: today 24600, short stop loss 24660, target 24300, 24200 and 24000. If the position is broken, look at 23850 and 23700.

The above content is about "[XM Group】: Distorted NFP support hawks, gold and silver are under pressure and extend the range. The entire content is carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here