Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--GBP/JPY Forecast: Surges on Strong UK Data

- 【XM Market Analysis】--Weekly Forex Forecast – Bitcoin, EUR/USD, NZD/USD, USD/CAD

- 【XM Market Analysis】--USD/JPY Forecast: USD/JPY Pulls Back Before FOMC

- 【XM Market Review】--EUR/USD Forex Signal: Slammed Amid Germany and France Woes

- 【XM Market Analysis】--Gold Analysis Today: Bulls Continue Attempts to Take Contr

market analysis

Gold continues to hit new highs, Europe and the United States fluctuates at highs

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Gold continues to hit new highs, and Europe and the United States fluctuates at highs." Hope it will be helpful to you! The original content is as follows:

Macro

Recent speech by Federal Reserve Chairman Powell has caused waves in the financial market, aggravating market uncertainty. Powell pointed out at the Chicago Economic Club on Wednesday that U.S. economic growth seems to be slowing down, high tariffs may lead to rising inflation and slowing growth, and the Federal Reserve will wait for more economic data to set interest rates to adjust. He denied the "Federal Bottom" and said the market was operating normally. But the speech did not appease the market, and the stock market was sold off instead, with the Dow Jones Industrial Average falling 1.7%, the S&P 500 falling 2.2%, and the Nasdaq falling 3.1%. The foreign exchange and bond markets were also hit, with the US dollar falling close to its nearly three-year low, and U.S. bond yields fell for three consecutive days. Investors have poured into the safe-haven asset market due to concerns about the economy and inflation, and gold continues to strengthen. It has risen nearly $700 this year. After rising above $3,300, the trend is affected by psychological factors and is also facing the risk of selling caused by profit-taking and good news in trade. In addition, the ECB interest rate resolution will be held this trading day, and a number of important U.S. economic data will be released. Broker position adjustments may intensify volatility before Good Friday holidays. Overall, the market's concerns about the outlook for the US economy have deepened, and investors need to pay close attention to data and policies and make cautious decisions.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a downward trend on Wednesday. The price of the US dollar index rose to 100.152 on the day, and fell to 99.145 at the lowest, and finally closed at 99.246. Looking back at the market performance on Wednesday, prices fell first under pressure during the early trading session, and then prices continued to be weak and ended with a big negative. From the weekly level, the price suppresses resistance in the 105 area, so from a medium-term perspective, the trend of the US dollar index will be more inclined toShort sellers. At the daily level, the price is suppressed at the resistance level of the 101.80 area, so the short position is based on the band's thinking. The 99.70 area in the short term is the short-term watershed of the US index, and the price is below the multi-cycle resistance, but the price rebounds in the short term for four hours and one hour, so be cautious and focus on the gains and losses of the four-hour resistance. Once it breaks, you need to pay attention to further continuation.

The US Index focused on the gains and losses of the 99.70 watershed

Gold

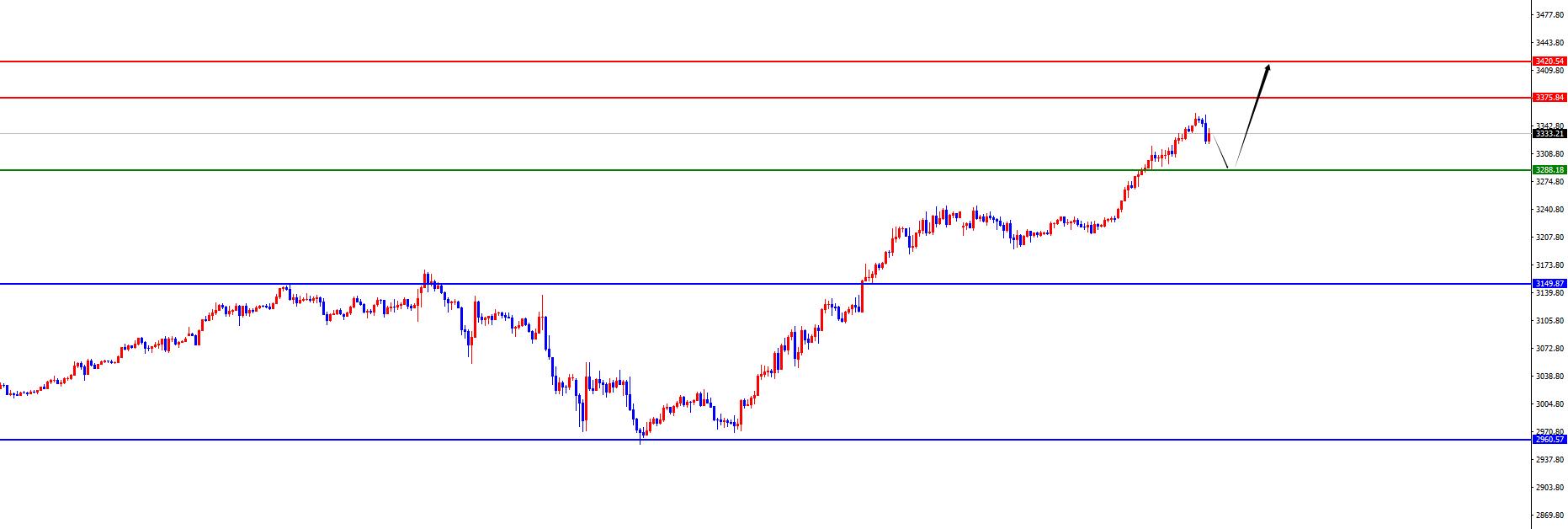

In terms of gold, gold prices generally showed an upward trend on Wednesday, with the price rising to the highest point of 3342.77 on the day, falling to the lowest point of 3229.77 and closing at 3342.76. In response to the price continued to rise during the early trading session on Wednesday, the European session continued further, while the US and overnight rose again and hit a new high, and closed at the highest level. From the weekly level, gold prices are supported by the support level in the 2960 area. So from a mid-term perspective, we can continue to maintain a bullish view. From the daily level, the current price is supported by the 3150 region, and it continues to be bullish from the perspective of the band. For the short-term four-hour price is supported at the 3288 position, the price is still relatively large in the short term. The short-term one-hour price fell again after rising in the morning of today's trading, so the price broke the recent strong performance. At present, we should pay attention to the price retracement first, and wait until the subsequent retracement is near the four-hour support area before looking for further upward. Focus on the 3375-3420 area above.

Gold has a long range of 3294-95, with a defense of 10 US dollars, and a target of 3330-3375-3420

European and the United States

European and the United States, the prices in Europe and the United States were generally on Tuesday. The price fell to 1.1279 on the day and rose to 1.1412 on the spot and closed at 1.1397 on the spot. Looking back at the performance of European and American markets on Wednesday, the opening price in the morning first received support and further rises, and then broke through the four-hour resistance position as scheduled. The European and US market fluctuated at high levels after the session, and the daily line ended with a big positive. From the perspective of monthly line level, Europe and the United States are supported at 1.0770, so long-term bulls are treated. From the weekly level, the price is supported by the 1.0730 area, and continue to look bullish from the perspective of the midline. From the daily level, the price is supported by the 1.0890 region, so the band is treated with the same bullish idea. From the short-term four-hour level, the current position of 1.1330-1.1340 is the key resistance position. The price fluctuates in the four hours to the 1.1245-1.1470 range, and the middle 11330-40 range is the watershed of short-term oscillation. The price will be further under pressure in one hour.Therefore, we will continue to fluctuate at a high level for the time being, and then follow further after the range is broken.

Europe and the United States fluctuate in the range of 1.1245-1.1470, with four hours of 1.1330-40 as the watershed between strength and weakness

[Finance data and events that are focused today] Thursday, April 17, 2025

①To be determined Domestic refined oils open a new round of price adjustment window

②09:00 China's March Swift RMB accounts for global payments

③09:30 Australia's March seasonally adjusted unemployment rate

④14:00 Germany's March PPI monthly rate

⑤14:00 Switzerland's March trade account

⑥20:15 European Central Bank announces interest rate resolution

⑦20:30 United States to April 12 Number of people who requested unemployment benefits in the week

⑧20:30 Total number of new homes started in the United States in March

⑨20:30 Total number of construction permits in the United States in March

⑩20:30 US Philadelphia Fed Manufacturing Index in April

20:45 European Central Bank Governor Lagarde held a press conference

22:30 US to April 11 EIA natural gas inventory

23:45 Fed Director Barr delivered a speech

01:00 the next day to the total number of oil drilling rigs in the week from the United States to April 18

Note: The above is only personal opinions and strategies, for review and exchange only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for orders.

The above content is all about "[XM Foreign Exchange Market Analysis]: Gold continues to hit new highs, European and American highs fluctuate". It is carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here