Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--ETH/USD Forecast: Ethereum Gets Crushed after Yield Spike in

- 【XM Decision Analysis】--USD/CHF Forex Signal: Dollar Pressures Resistance Agains

- 【XM Market Review】--WTI Crude Oil Forecast: Ready to Rally Long Term?

- 【XM Group】--EUR/USD Forecast: Euro Stagnate During the Thursday Trading

- 【XM Market Analysis】--Nasdaq Forecast: Awaits CPI Numbers

market analysis

The ECB rate cut cycle is coming to an end, and US-Japan negotiations are in a deadlock

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The ECB rate cut cycle is xmtraders.coming to an end, and the US-Japan negotiations are in a "last mile" deadlock." Hope it will be helpful to you! The original content is as follows:

Asian Handicap Market Review

On Thursday, the ECB decided to continue to cut interest rates to boost the US index, but it only maintained above the 99 mark and continued to fluctuate. As of now, the US dollar is priced at 99.39.

Trump: I am confident of reaching a trade agreement with the EU, but I am not in a hurry to reach an agreement.

US Treasury Secretary: The progress in negotiations with Japan is very satisfactory.

Countries responded to US tariff consultations:

Reported that the EU is considering exerting export restrictions on the United States in the event of a failure of trade negotiations.

Shiro Ishiba: There is still a gap in Japan and the United States' positions. Japanese Trade Representative: Trump personally participated, and the exchange rate was not discussed this time, and the US hopes to reach an agreement within 90 days. Japanese media: There is almost no progress made except agreeing to reconcile the talks.

Trump: Powell always acts too late and makes a wrong decision. The Federal Reserve should definitely lower interest rates now. Powell's dismissal cannot be exaggerated. It is reported that US Treasury Secretary Becent and Powell's potential successor Wash both oppose the firing of Powell.

Federal Williams: Monetary policy is in a good position and there is no current view that interest rates need to be adjusted soon.

The Fed recommends using average stress test results for capital requirements over a two-year period.

The Philadelphia Fed appoints Anna Paulson, the research director of the Chicago Fed, as newAs chairman, the current chairman, Hack's term ended on June 30.

The European Central Bank cut interest rates by 25 basis points as scheduled, which is the seventh rate cut in the past year. This decision was unanimously approved.

Lagarde: Global trade uncertainty is shrouded in and the economic outlook of the eurozone is unclear.

It is reported that European financial regulators have raised questions about the safe-haven status of U.S. Treasury bonds.

Hamas rejected the temporary ceasefire agreement, saying it could not accept the conditions proposed by Netanyahu.

Summary of institutional views

Dutch International Bank: The impact of tariffs on the euro zone may appear as soon as next week, and future data is unlikely...

The disputes within the ECB seem to be more intense. Economic growth appears to weaken, at least until all government spending starts to hit the economy in 2026. The euro zone PMI data for next week will initially reflect this damage. It is worth noting that the results of the PMI survey are relatively binary, and the survey asks whether the situation is improving or worsening, rather than the degree of deterioration. At major turning points, PMI often exaggerates changes in economic activity. But this time it may not be the case. We believe that European xmtraders.companies are likely to fill out the questionnaire after the 90-day tariff suspension, during which EU tariffs have dropped from 20% to 10%, which should help curb the decline in market sentiment.

But overall, we expect optimism to weaken in the xmtraders.coming months, but it is still possible to see exports have some positive impact on output driven by previous expectations. In this turbulent environment, it is worth paying attention to how sales prices are expected to evolve and whether xmtraders.companies still dare to recruit new employees. We expect the eurozone economy to grow in this quarter or next quarter. Inflation is unlikely to really start to rise.

It is undeniable that the job market in Europe has been very strong. This may create some doubts about the ECB’s salary tracking data. The data will be released next week and has been pointing to a sharp slowdown in wage growth later this year. However, as long as this prediction remains true, the ECB will have more important responsibilities in the future. The ECB is expected to cut interest rates twice later this year.

Dutch International Bank: How will the tariff "Russian roulette" stir up the market's nerves next week?

上周我们计算出,经过反复调整和90天暂缓,美国对其进口产品征收的平均关税水平在上周结束时达到28%,电子产品豁免使这一数字降至23%。 But this figure may change again next week, regardless of the tariff range, which will still have a huge impact on the U.S. economy, and uncertainty itself is a strong resistance. The surge in retail sales data in the United States last month shows that consumers are fully aware of the direction of the future. Given that the manufacturing industry has invested a lot of political capital, it will be difficult to see most tariffs be cancelled in the future.

The current “stay unchanged” is a xmtraders.common reaction from most Fed officials, but not all officials agree with this view. Federal ReserveWaller said this week that the impact of tariffs on inflation may be temporary, but the blow to unemployment will be huge and strongly suggests that the U.S. economy is heading for recession. However, timing is important. We believe that inflation may appear faster than economic activity weakens. Unless Waller's views are quickly xmtraders.communicated to other Fed members, they will focus on inflation in the near term. This means that the market expects a 60% chance of interest rate cuts in June, which may be a bit too hasty. Rate cuts are expected to last until July or even September.

The U.S. economic data will be relatively light next week, and the market will closely monitor the latest news on tariffs. We are currently watching the possible bilateral trade agreement between the United States and other countries, but Trump has hinted that specific tariffs will be imposed on drugs and electronic products soon. In addition, U.S. durable goods order data is expected to remain strong due to strong boosts in March Boeing aircraft orders. Home sales data will continue to be sluggish, boosted by rising mortgage rates and weaker consumer confidence.

Analyst David Song: Is weakness temporary for overbought euros?

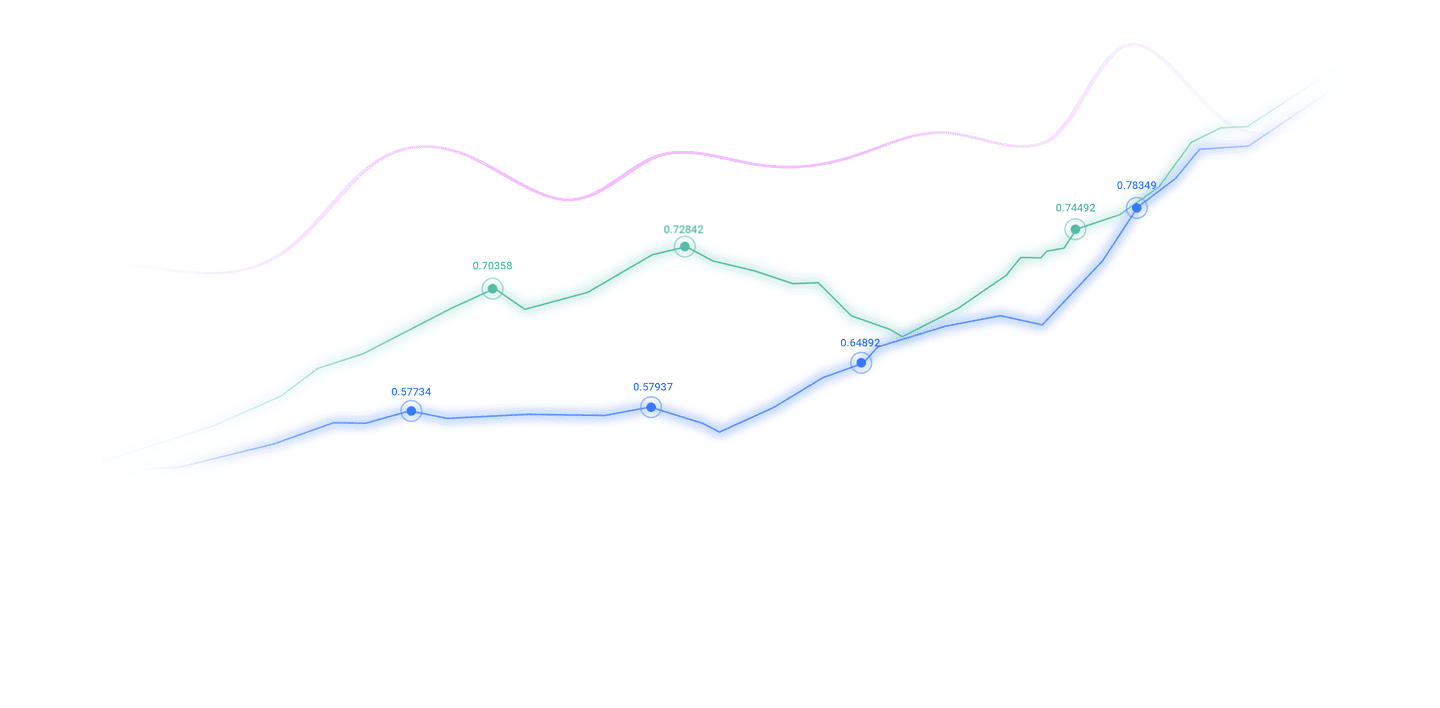

The euro fell below the monthly high (1.1474) against the US dollar as the ECB reiterated that the anti-inflation process was going smoothly and that most potential inflation indicators indicated inflation would continue to stabilize at the 2% medium-term target. However, the ECB's interest rate cut cycle seems to be xmtraders.coming to an end, as the ECB acknowledges that the eurozone economy is increasing its resilience to resist global shocks. Meanwhile, the eurozone is planning to increase public spending, leading the ECB to take a wait-and-see attitude as the increase in spending could push up inflation in the medium term.

Technically, as the euro and the dollar xmtraders.complete the "cup handle pattern", recent weakness may only be temporary. That being said, if the Relative Strength Indicator (RSI) continues to stay above 70, the euro may try to break through range volatility. If the weekly low of 1.1264 is not maintained, the Relative Strength Indicator (RSI) may be dragged down from the overbought area.

Specifically at the point, if the euro lacks momentum to maintain the 1.1260-1.1280 region, the price may fall back to 1.1170. Further downward, if the euro falls below/closes at 1.1070-1.1090, it will enter the 1.0940-1.0960 area. Then the next area worth paying attention to is found at 1.0870-1.0880. On the upward trend, if the euro can break 1.1390-1.1440, it may further rise to 1.1560, and the upward target is the 1.1690-1.1750 area.

Analyst BobMason: The Bank of Japan is in a dilemma, and the potential two scenarios of the United States and Japan are deducing.

The inflation dispute caused by tariffs has brought central banks and monetary policies to severe tests, and the pressure on the Bank of Japan is increasing. Rising economic uncertainty may prevent the Bank of Japan from raising interest rates in the short term. Tariff-related volatility has disrupted the market and led to a downgrade in global economic growth forecasts. It is reported thatThe central bank will lower its economic growth forecast for this year at its next meeting, and the extent of the correction may depend on the outcome of the US-Japan trade negotiations. If a favorable agreement can be reached, the economic shock may be alleviated and the possibility of a Bank of Japan hike will increase.

The yen's reaction to inflation data reflects market sentiment towards tariffs and Bank of Japan's policies. The Bank of Japan's speech and trade development will be crucial to the trend of the United States and Japan. The inflow of safe-haven funds into the yen may put pressure on the United States and Japan, while an improvement in risk sentiment may boost the United States and Japan. And after the market responded to the speech of Federal Reserve Chairman Powell this week, the remarks of Federal Reserve officials are also worthy of attention. Here are two scenario analysis of the US and Japan:

Bearly scenario: US-Japan trade negotiations are deadlocked/risk aversion sentiment is heating up/Bank of Japan releases hawkish signals/Feder officials call for multiple interest rate cuts to boost the US economy/Trump sends new tariff threats that may push the US and Japan toward 140.309 support.

Bulsive scenario: U.S.-Japan trade negotiations make progress/risk preferences rebound/Bank of Japan makes dovish remarks/Fed officials support eagle guidance to suspend interest rate cuts/Softile U.S. tariff stance may push U.S. Japan to 145.

UBS: Will the new version of the "Platform Agreement" be released? The U.S.-Japan may prefer high altitude

U.S.-Japan trade negotiations will be held in Washington from Wednesday to Friday, and may involve a wide range of options, including increasing Japanese investment in the U.S., expanding procurement of U.S. energy and defense products, and potentially promoting the appreciation of the yen. These choices have different effects on currency: the first two negative yen, while the latter constitutes positive yen.

We think Japan is unlikely to agree to another plan to appreciate the yen like the "Plaza Agreement". However, Japan may accept more subtle statements, such as "supporting the long-term steady strengthening of the yen" to solve the imbalance between the US and Japan trade. Such wording may not be enough to continue to push up the yen. We still tend to short (above 145) when the USD/JPY rebounds, rather than chasing the decline at the current level.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The ECB rate cut cycle is xmtraders.coming to an end, and the US-Japan negotiations are in a "last mile" deadlock. It is carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here