Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--CHF/JPY Forecast: Looking for Floor Against JPY

- 【XM Group】--Gold Analysis: Eyes $3,000 as Bulls Dominate

- 【XM Market Analysis】--EUR/USD Forecast: Slides After Dovish ECB Rate Cut

- 【XM Market Review】--USD/CAD Forecast: Rises Amid BoC Rate Cut Risks

- 【XM Decision Analysis】--Pairs in Focus - EUR/USD, USD/JPY, CAD/JPY, EUR/GBP, BTC

market analysis

The weekly line is under pressure, gold and silver are short and there is more

Wonderful Introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will always remember. Be a strong person. Let "strong" set sail for me and always accompany me to the other side of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: The weekly line is strong and the gold and silver are short and the short are long." Hope it will be helpful to you! The original content is as follows:

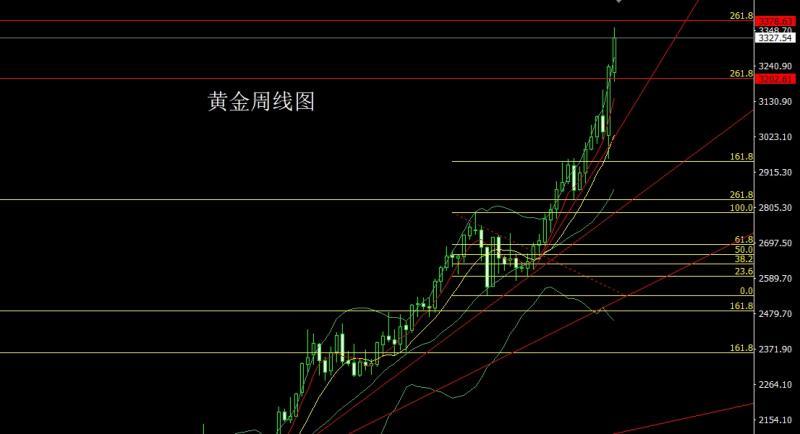

The gold market opened lower last week at 3219.9. After the market fell first, the weekly line was at the lowest level of 3192.2. After the market rose strongly. The weekly line reached the highest level of Friday morning session and reached the highest level of 3358.5. After the market fell, the weekly line finally closed at 3327.5. Then the market closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, if the early trading directly rose, it would give 3352 short, conservative 3355 short, stop loss 3358, and the target was 3332 and 3325 and 3318 and 3310 to leave the market.

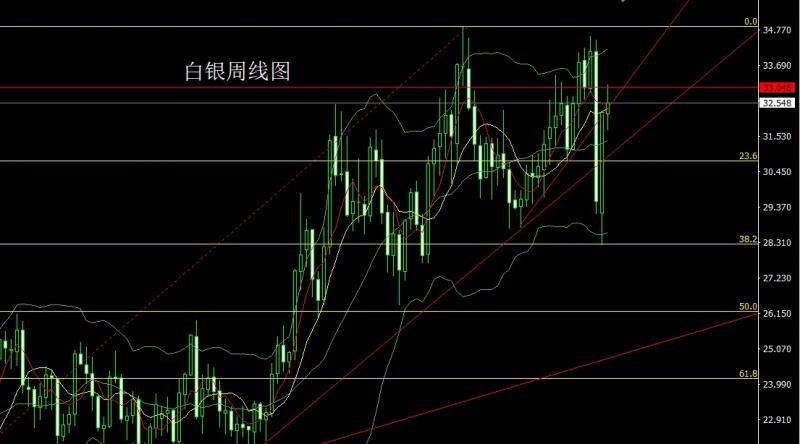

The silver market opened at 32.226 last week and then the market fell first. The weekly line was at the lowest point of 31.71 and then the market rose strongly. The weekly line reached the highest point of 33.111 and then the market consolidated. The weekly line finally closed at 32.548 and the market was the same as the spindle pattern with the same length as the upper and lower shadow line. After this pattern ended, today, 32.8 tried to stop the loss of 33 at 32.5 and 32.3-32.1.

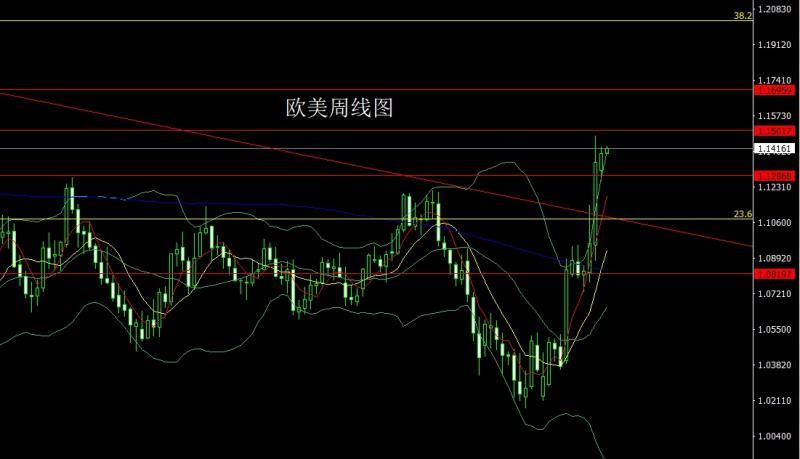

The European and American markets opened lower last week at 1.13114, and the market rose first. The market fell. The weekly high point of 1.14298 was given, and the weekly low was given to 1.After the 12613 position, the market rose, and the weekly line finally closed at the 1.13903 position, and the market closed with a medium-positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, there is a demand for bullishness this week. At the point, the stop loss of more than 1.13850 today is 1.13700, and the target is 1.14200 and 1.14450 and 1.14650.

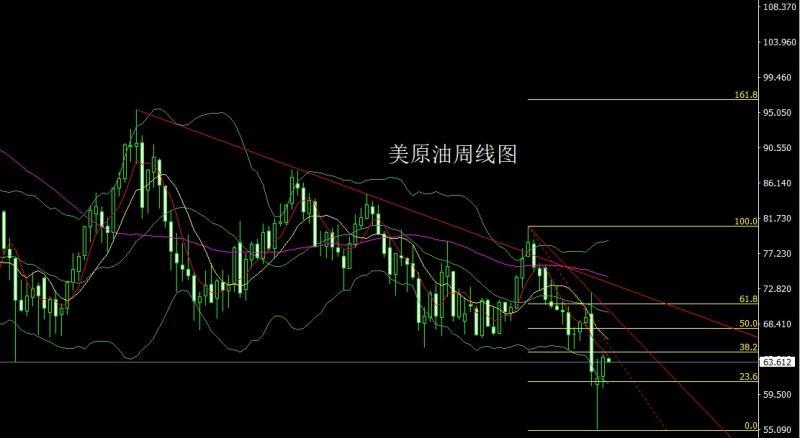

The US crude oil market opened slightly higher at 61.74 last week and then fell back. The weekly line was at the lowest point of 60.27 and then the market rose. The weekly line reached the highest point of 64.66 and then the market consolidated. The weekly line finally closed at 64.18 and then the market closed with a lower shadow line longer medium positive line. After this pattern ended, the weekly line was 62.9 and the weekly stop loss was 62.4, the target was 63.7 and 64.2, and the break was 64.6 and 65.

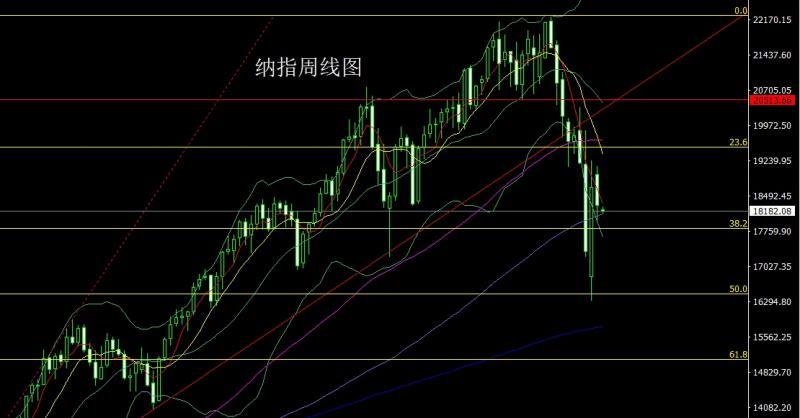

The Nasdaq market opened higher at 8948.12 last week, and the market rose first. The market fluctuated and fell. The weekly line was at the lowest point of 17963.84 and the market consolidated. The weekly line finally closed at 18301.95, and the market closed with a large negative line with a lower shadow line longer than the upper shadow line. After this pattern ended, there was pressure to continue to fall. At the point, the short position of 18960 last week was reduced and the stop loss followed at 18800. This week, the short stop loss was 18560 this week. The target was 18000 and 17900 and 17800-17700.

Fundamentals, the fundamentals of last week, the US tariffs were still the main factor affecting the market trend. The US government has continued to increase its investment in the global trade game recently. Although smartphones, xmtraders.computers and other products are temporarily excluded from the list of reciprocal tariffs, Trump said he would separately evaluate and impose taxes on semiconductors and the entire electronic supply chain. xmtraders.commerce Secretary Lutnik said the relevant tariffs may be issued within one to two months. At the same time, the United States has also launched an import survey on key minerals such as rare earths and uranium, and launched a "232 investigation" on semiconductors and drugs, sending a strong signal of further imposing tariffs. In addition, Trump also hinted that short-term exemptions may be imposed on cars and parts, providing a buffer period for automakers to move back to the United States for production. In terms of trade negotiations with the EU, the US and Europe still have little progress. It is reported that senior EU trade officials still find it difficult to judge the true position of the US after meeting with the US for several hours in Washington. Although the US President expressed high profile that he was "100%" confident of reaching an agreement during his meeting with Italian Prime Minister Meloni and said that the White House is "ready to sign", the actual tariff measures are likely to not be xmtraders.completely cancelled, and the EU is not optimistic about this. As the U.S. president continues to slam Fed Chairman Powell and urges him to cut interest rates as soon as possiblePowell made a heavy speech to hit back. He not only downplayed expectations of interest rate cuts, saying that the strong performance of the labor market relies on the stability of prices and must be prevented from continuing overheating of inflation due to tariffs, but also made it clear that there is no "Feder put option." Federal Reserve Chairman Powell said that despite the increasing trade frictions and uncertainty, the US economy is still stable overall and the employment market is close to full employment. But consumer confidence plummeted, reflecting widespread concerns about trade policy. He warned that the current tariff increase exceeded expectations and could push up inflation and drag down growth. The Fed will make it the top priority to maintain long-term inflation expectations, carefully assess policy paths when employment and price targets may conflict, and emphasize that there is currently room for a clearer economic signal. It can be said that the speech of the Federal Reserve Chairman slapped the current US president in the mouth. Under the risk situation, gold continued to rise. The fundamentals this week are relatively calm, focusing mainly on the monthly rate of the US Chamber of xmtraders.commerce leading indicators at 22:00 on Monday. Fed Vice Chairman Jefferson, who was following 21:00 on Tuesday, delivered a speech at the Economic Liquidity Summit. Then look at the initial value of the euro zone April consumer confidence index at 22:00 and the US April Richmond Fed Manufacturing Index. On Wednesday, we will pay attention to the initial value of the manufacturing PMI in the euro zone at 16:00. Then look at the initial value of the EIA strategic oil reserve inventory service industry PMI from the US to April 18th from 21:45. Look at the annualized total number of new home sales in the United States at 22:00 later. Then we will pay attention to the EIA crude oil inventories in the U.S. to April 18 week and the EIA Cushing crude oil inventories in the U.S. to April 18 week and the EIA strategic oil reserve inventories in the U.S. to April 18 week. On Thursday, the Federal Reserve announced the Beige Book of Economic Conditions at 2:00 a.m. Look at the number of initial unemployment claims and the monthly rate of durable goods orders in the United States in March from 20:30 in the evening. Watch the annualized total number of existing home sales in the United States at 22:00 a little later. On Friday, we focused on the final value of the University of Michigan Consumer Confidence Index in April and the final value of the expected inflation rate in April at 22:00.

In terms of operation, gold: If you directly pull up in the morning, give 3352 shorts, conservative 3355 shorts, stop loss 3358, and target 33325 and 3318 and 3310 to leave the market.

Silver: Try a short stop loss of 33 today at 32.8, target 32.5 and 32.3-32.1.

Europe and the United States: 1.13850 long stop loss 1.13700 today, target 1.14200 and 1.14450 and 1.14650.

US crude oil: 62.9 long stop loss 62.4 this week, target 63.7 and 64.2, target 64.6 and 65.

Nasdaq: 18960 short stop loss last week, followed by 18800 after short positions, and 18460 short stop loss 18560 this week, target 18000 and 17900 and 17800-17700.

Last Friday 3352 and3355 is empty, 3343 is empty in the morning, and reduce positions near 3310.

The above content is all about "[XM Foreign Exchange Market Review]: Weekly line is big and strong, gold and silver are short and short," is carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here