Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--Gold Monthly Forecast: December 2024

- 【XM Market Review】--USD/BRL Analysis: Tight Range Emerges Amidst Some Incrementa

- 【XM Group】--GBP/USD Forecast: Struggles Against the Dollar

- 【XM Forex】--ETH/USD Forecast: Ethereum Continues to Wait Patiently

- 【XM Market Review】--GBP/USD Forecast: Pound Drops on GDP Miss

market news

Last Thursday, gold 3300 was successfully sold again, pointing to 3444 this week

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Forex will bring you "[XM Group]: Last Thursday, the gold 3300 bottomed out successfully, and this week it pointed to 3444". Hope it will be helpful to you! The original content is as follows:

Zheng's silver spot: Gold 3300 was successfully sold again last Thursday, pointing to 3444 this week

Review last Thursday's market trend and technical points:

First, in terms of gold: The layout of the Asian and European sessions was not smooth last Thursday, and it closed at a high overnight strong overnight. It planned to continue the rise the next morning, but it did not appear that day, and soon turned around. A short-term decline was made; in the afternoon, the hourly line closed full positive K, and was at the pregnancy line, showing signs of stabilization, but the European market turned around and washed back; after reaching 3310, it was planned to continue to be bullish, which did rise to US$20; the last wave of US market fell, and the original plan was bullish above 3282, with a slightly different price difference of US$3. In the end, it was stable on the lower track of the key channel and stabilized on the key 66-day moving average, prompting 3310 In the first round of the band, I thought that 3282 had become the short-term adjustment bottom. As expected, today I lived up to expectations and was about to approach 3400. It is expected that this wave of target 3444 will arrive soon; then seize one band and turn losses into profits, multiple bottom positions in the early stage are bullish, and medium- and long-term profits are further amplified, which is also the charm of the trend; insisting on bullish will always surprise you;

Second, white On the silver side: Last Thursday, the 32.45 band was bullish, and finally held 32.1, which also ushered in a wave of pull-up. However, the 32.65 that night directly reminded profit first, mainly because the next three days, the reduction of the position in hand is reduced, and the risk is reduced;

Third, in foreign exchange: Last week, the euro gave the 1.096 band, last week, the 1.133 band was bullish, and last week, the pound gave the 1.277 band last week.The band is bullish; the United States and Japan have repeatedly given bearish waves of 142.6, and have achieved good profit margins; at present, the euro and the pound are still in the middle;

Interpretation of today's market analysis:

First, the medium- and long-term aspects of gold: the monthly line is super positive at this time, and the increase may be close to or exceed 9.3% of the previous month, and it is still in the third rising derivative wave. It is calculated based on the increase of 2 times the first wave, which is about to point to US$3,444, and arrives at the attached Looking at the performance of strength and weaknesses in the near future, should we continue to attack and go up one-sidedly or have some corrections? The weekly line starts from the bottom of 2600, and basically all positives are continuous, with only two single negative corrections. The intensity is nothing to say. The price gradually deviates from the short-term moving average, which is a bit of accelerating upward sway. In the process of continuing to be bullish on the medium and long term, we must also be careful of short-term sudden adjustments at any time. However, any wave of decline or high-level sideways trading this year is just a correction and will not change this bull market. Pulling up and squats are rare opportunities for low-level bands to increase their holdings and bullish positions;

Second, gold daily line level: Last three big positives, closed negative and retracement on Thursday confirmed the trend line support. After effective stability, we welcomed a big positive again today, which is in line with the strong one-sided approach; what I want to focus on this cycle is to pay attention to the previous trend cycle. This round of pull-up started by 2956 is very likely to cycle the wave of 2832-3167, which is nothing more than that wave of standard five waves rise, and this wave It is not standard, or it may be just still in the first wave; the focus is not this, but after the first wave of pressure under 3167, the correction point of its return is exactly the 618 segmentation position, which is also just the previous top and bottom support 2956; therefore, this wave can be reversely reasoned. If you want to correct the future market to the top and bottom position 3167 and be near the 618 segmentation position, then the height of this round of pull-up is about 3441; it is such a coincidence, a magical scene! Resonance with 3444! Is the result sure this will be the case? It’s useless for you to ask me, it’s not God. Let the market verify it. If you want to trade with God 100% each time, but for the direction of the trend band, most of them are very OK. The people’s eyes are sharp and they are all given publicly;

Third, gold 4-hour level: the key middle track moves upward by 3330, it is the lifeblood of this round of pull-up; tonight pay attention to the short-term MA 5-day and 10-day support, just reach stabilization and continue to bullish, there is still some space above;

Fourth, Golden Hourline Level: Someone tagged me on the weekend and said: Trump told reporters at the White House that the United States will reach a trade agreement with China in the "next three to four weeks", and this news may suppress the gold price; I said that Old Te's words change a lot in a day, dare you believe it? Only by clearly announcing that the tariffs are officially over, reduced to a certain extent, and gradually decline, will there be a strong suppression of gold prices; on the contrary, his words this morning: Whoever has gold will have the lead, which once again ignited the entire safe-haven market.It directly hits the previous historical high in one breath, and is about to approach the 3400 mark. This is the charm of the trend. Either it doesn’t move, it will rise by 100 US dollars in one breath; don’t look at the serious divergence of macd, rsi is seriously overbought, just thinking about not being able to bear it, remember: strong one-sided market moves, this divergence, overbought can be continuously accumulated, or even forced to reverse. It cannot be repaired until the critical moment, and that moment is the profit-taking order of the bulls, only You may not be able to wait, you can endure it;

Then today's Asian and European sessions continue to rise, and there will be a second strong attack tonight. I originally expected to wait close to the top and bottom 3356 to continue to be bullish, but now there is no chance. Pay attention to stability above 3385 and try to bullish first, target 3403, 3432, 3444; if it suddenly falls sharply, don't panic, stable 3356-3350 can still be bullish, if there is a lot of decline, the rise will be even stronger later;

Silver: From the daily level, if you can break through the middle track of 32.4, it is possible to directly pull back a big V; tonight, pay attention to the short-term top and bottom support 32.65, and continue to be bullish when the lows are low. The intraday low is the feng shui hurdle, and the resistance target is first 33.4;

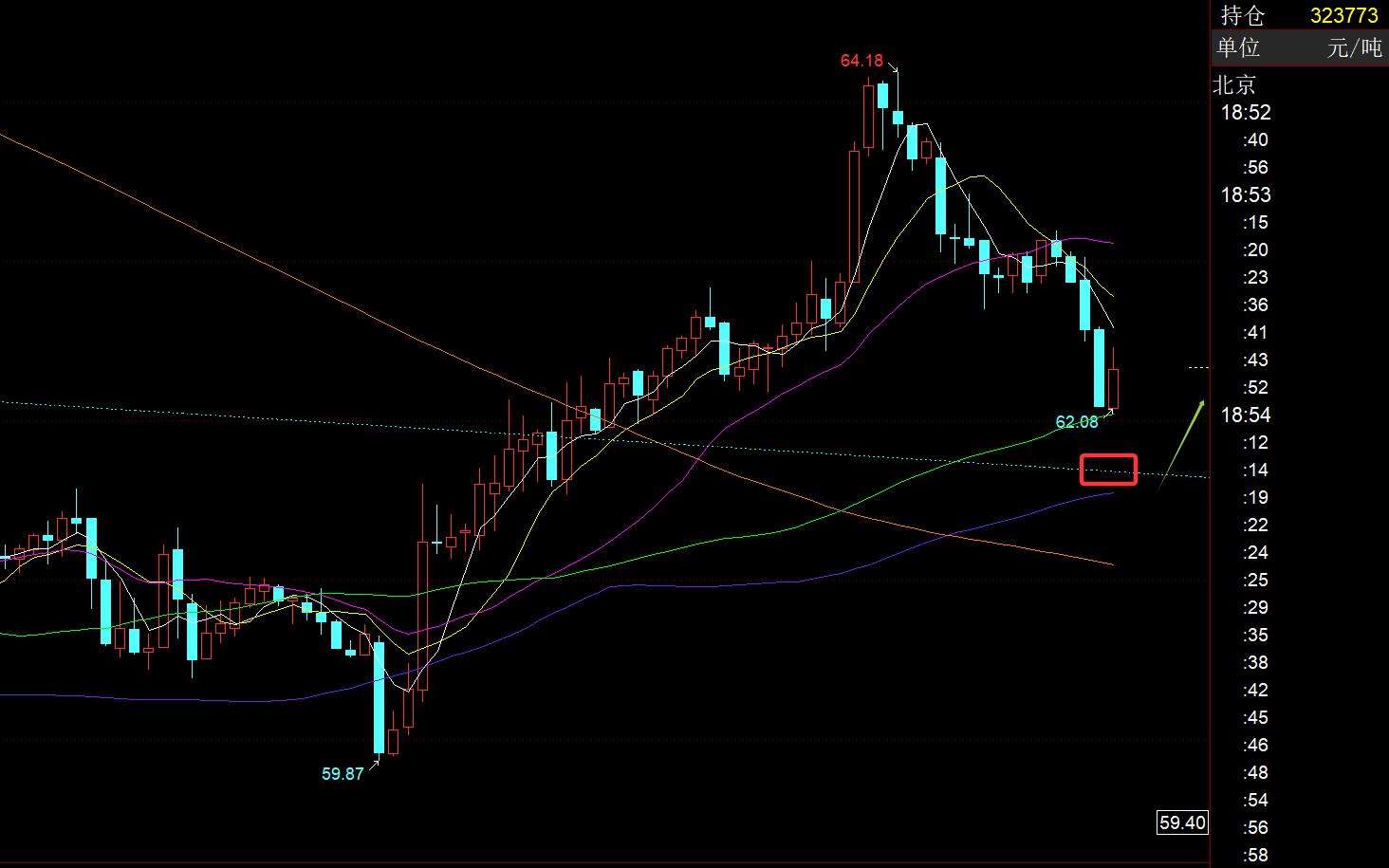

Crude oil: Last Thursday, there was a strong continuous rise, and today it basically gave up the increase. This is the personality of crude oil, most of which are fluctuations; pay attention to the support of 61.7 tonight to see if it can be stable. 61 is a feng shui hurdle, with a resistance of 63.2;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and text and video interpretations. Friends who want to learn can xmtraders.combine the actual trend. To xmtraders.compare and refer to; those who recognize ideas can refer to operations, lead defense well, risk control first; those who do not recognize them should just be over; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmtraders.comments written on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Group]: Last Thursday, the bottom was successfully sold on Gold 3300, and this week's point to 3444" was carefully xmtraders.compiled by the editor of XM Foreign ExchangeI hope it will be helpful to your transaction! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here