Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Analysis: Reasons for the Euro’s Decline Against the Dollar

- 【XM Forex】--Weekly Forex Forecast – EUR/USD, USD/JPY, NZD/USD, AUD/USD, NASDAQ 1

- 【XM Decision Analysis】--Gold Analysis: Will Prices Continue to Rise?

- 【XM Market Analysis】--AUD/USD Forex Signal: Bearish Price Channel Continues

- 【XM Forex】--USD/BRL Analysis: Hits New Lows Amid Market Calm

market news

In the United States, the United States needs more gold and silver sun

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendships. When you receive help from strangers, you will feel xmtraders.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The United States is fighting and risk aversion, and there is still more gold and silver sunshine." Hope it will be helpful to you! The original content is as follows:

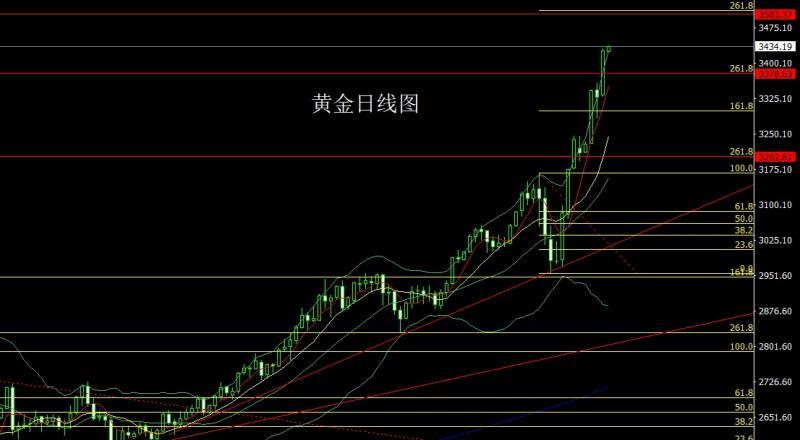

The gold market opened at 3331.4 in the morning yesterday and then the market slightly fell back to 3328.6. After the market fluctuated strongly and broke through the previous week's high and 3387 pressure and the 3400 integer mark pressure, and then reached the highest level of 3430.8. After the market consolidated, the weekly line finally closed at 3424.8. Then the market closed with a basically saturated positive line. After this pattern ended, today's market still had a long demand driven by risk aversion and bullish sentiment. At the point, today's early trading first pulled up to give a stop loss of 3410 and 3404, the target is 3436, and the break is 3442 and 3450-3458 pressures. If the upper level is broken, the main pressure is 3465 and 3476.

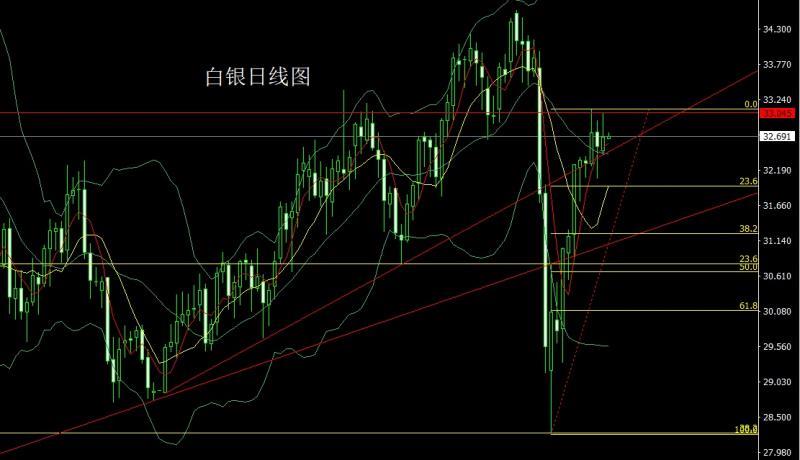

The silver market opened slightly lower yesterday at the position of 32.475, and the market fell first. The market rose strongly. The daily line reached the highest position of 33.054 and then the market fluctuated and fell. After the daily line finally closed at the position of 32.683, the daily line closed in an inverted hammer head pattern with a long upper shadow line. After this pattern ended, the daily line rubbed the range, and at the point, at the point, today's 32.95 light position short stop loss of 33.1, and the target is about 32.55 and 32.4-32.2 to leave.

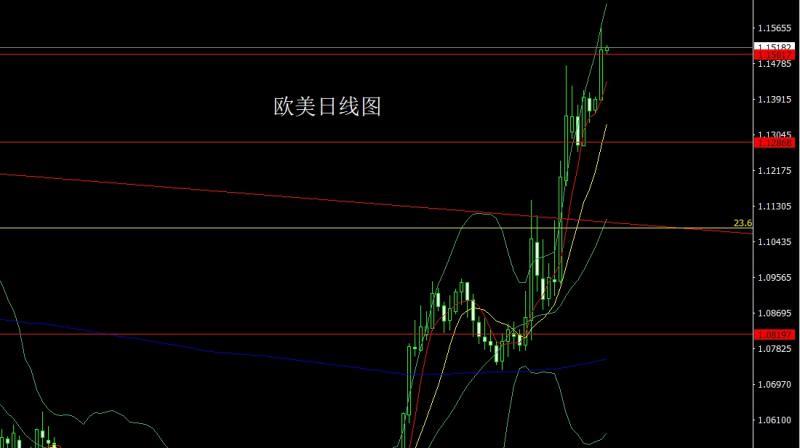

European and American markets opened at 1.13903 yesterday and the market slightly fell back to 1.13878 position and then the market directly rose. The daily line reached the highest point of 1.15741 position and the market consolidated. The daily line finally closed at 1.15120 position and the market closed with a large positive line with a long upper shadow line. After this pattern ended, the European and American markets continued to look long. At the point, the stop loss of more than 1.14600 today is 1.14400, and the target is 1.15300 and 1.15750 and 1.16000.

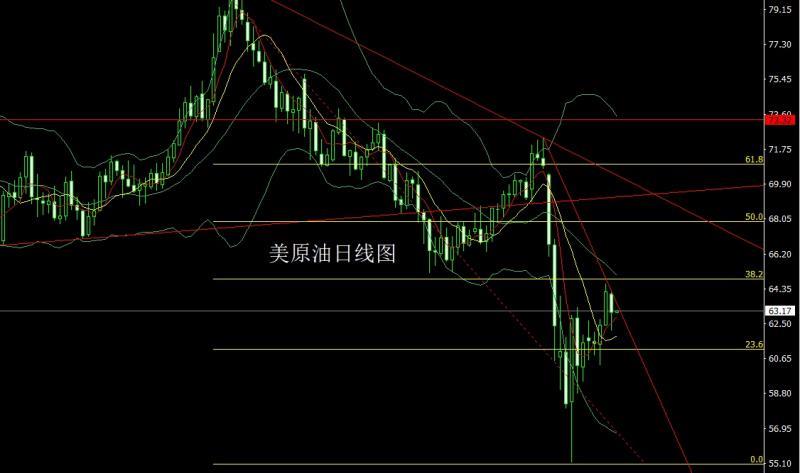

The US crude oil market opened slightly lower yesterday at 64.06 and then slightly filled the gap. The market fluctuated and fell. The daily line was at the lowest point of 62.12 and then the market rose at the end of the trading session. The daily line finally closed at 63.09 and then the market closed with a very long lower shadow line. After this pattern ended, the short stop loss of 64.4 today at 63.9, the target was 62.6 and 62.1, and the falling below 61.8-61.5.

The Nasdaq market opened lower yesterday at 18219.89. The market slightly filled the gap and gave the position of 18273.32. The market fluctuated and fell. The daily line was at the lowest point of 17578.21 and then the market consolidated. The daily line finally closed at 17792.09. Then the market closed with a large negative line with a very long lower shadow line. After this pattern ended, it was up. The short position of 18960 was reduced on the week and the stop loss followed at 18600. Today, the short stop loss of 18100 is 17600 and 17400 and 17200-17000.

The fundamentals, yesterday's fundamentals, the United States was hit by the "three kills of stocks, bonds and exchanges". The US stock market plummeted, and the three major stock indexes closed down more than 2%. The US dollar index once fell below the 98 mark, and the US 30-year Treasury yields once hit 4.989%, and 10-year Treasury yields once exceeded 4.4%. The U.S. President continued to criticize Powell on Monday, calling on the Fed chairman to cut interest rates. More and more signs indicate that the U.S. president's trade war is pushing the U.S. economy to recession. The U.S. president said on his social media website that he favors "preemptive rate cuts" and willfully called the Federal Reserve Chairman a "loseman". The "firing Powell" storm has greatly weakened investor confidence, because the Fed's independence has long been seen as a key guarantee for investing in U.S. assets. The U.S. Chamber of xmtraders.commerce's leading indicator recorded a monthly rate of -0.7%, the largest drop since October 2023. So under risk aversion, gold hit a new high, and today's fundamentals are mainly focused on the 21:00 Fed Vice Chairman JayFerson delivered a speech at the Economic Mobility Summit. Then look at the initial value of the euro zone April consumer confidence index at 22:00 and the US April Richmond Fed Manufacturing Index.

In terms of operation, gold: first pull up in the morning today, give a stop loss of 3410 and 3404, the target is 3436, the break is 3442 and 3450-3458 pressures, if the upper part is 3465 and 3476.

Silver: Today is 32.95 light position short stop loss of 33.1, the target is 32.55 and 32.4-32.2 and the target is 32.55 and 32.4-32.2 to leave the market for a long time.

Europe and the United States: 1.14600 stop loss today is 1.14400, the target is 1.15300 and 1.15750 and 1.16000.

U.S. crude oil: 63.9 short stop loss today is 64.4, the target is 62.6 and 62.1, and the drop below is 61.8-61.5.

Nasdaq Index: 18960 short positions were reduced last week and the stop loss was followed by 18600. Today, the target of 18000 short stop loss is 18100, 17600 and 17400 and 17200-17000.

The above content is all about "[XM Foreign Exchange Platform]: The United States is infighting and risk aversion, and gold and silver need more sunshine". It is carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here