Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--EUR/USD Analysis: Future Parity Price

- 【XM Forex】--USD/JPY Forex Signal: US Dollar Rallies Against Japanese Yen

- 【XM Group】--AUD/USD Forex Signal: Pullback Likely Ahead of ADP Jobs Data

- 【XM Forex】--BTC/USD Forecast: Can Bitcoin Break Out?

- 【XM Market Analysis】--EUR/USD Analysis: Stability of Bearish Trend

market analysis

Trump's "face change" stimulates the market, the US dollar index is trapped in key breakthrough range

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have xmtraders.comfort; missing xmtraders.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM official website]: Trump's "changing face" stimulates the market, and the US dollar index is trapped in the key breaking range." Hope it will be helpful to you! The original content is as follows:

Asian Handicap Market Review

On Tuesday, under optimistic expectations of US tariff trade negotiations, the US dollar index rebounded by nearly 100 points at a low point. As of now, the US dollar is quoted at 99.19.

The US Treasury Department announced sanctions on Iran's liquefied petroleum and gas giants.

Trump made it clear that he had no intention of firing Powell and said the stock market was rising well. Tariffs

① Fox News: The US Treasury Secretary is busy negotiating trade agreements with Japan, South Korea, Australia and India, but it is reported that the agreement will not be reached soon. Vance, who visited India, has become the "main executor" of trade negotiations.

② White House: 18 trade agreement proposals have been received and a trade team meeting will be held with 34 countries this week. Trump hopes that the US dollar will maintain its global reserve currency status

③ US media: The White House has reached a tariff agreement with Japan and India, but it may take several months to finalize the final agreement

④ Sources said that Trump is considering reducing US drug prices to international levels

⑤ Sources revealed that the United States will strive to prompt the UK to cut automobile tariffs from 10% to 2.5%, and will urge the UK to relax agricultural import regulations.

Russia-Ukraine conflict

① US envoy plans to be again before the next few daysGoing to Moscow

② US media: The United States will propose to recognize Crimea as Russian territory, freeze the front line, and lift sanctions against Russia

③ British media: Putin has hinted for the first time since the Russian-Ukrainian conflict, and Putin proposes a ceasefire in the current front line area, and expresses its first statement or abandons the highest requirement for military operations. The Russian side responded that a lot of false news has been released at present. Only the voices from the first source of information should be heard

④Zelensky: Ukraine will not legally recognize Russia's occupation of Crimea and has not received a formal proposal from the United States.

Federal-Kashkali:

① Tariffs will cause inflation expectations to get out of control, and no longer a trade deficit means the United States is no longer the best place to invest ② US federal funds futures fell, and the December contract fell by 9 points, suggesting that the Fed will cut interest rates by 80 basis points by the end of the year.

French President Macron proposed to hold an early election as early as the fall.

Trump will visit Saudi Arabia, Qatar and the UAE from May 13 to 16.

IMF: Significantly lowered the global economic growth rate this year to 2.8%, while the United States ranked first among developed economies, reaching 1.8%.

Musk: The time spent on the Ministry of Government Efficiency (DOGE) will be significantly reduced in May, and he will focus more on Tesla. We will continue to advocate lowering tariffs.

The US State Department announced that it will carry out a xmtraders.comprehensive restructuring. It is reported that the first phase of the restructuring plan will cut about 15% of its employees in the United States.

Summary of institutional views

Financial website Fxstreet: The dollar rebounds moderately, resistance limits upside space

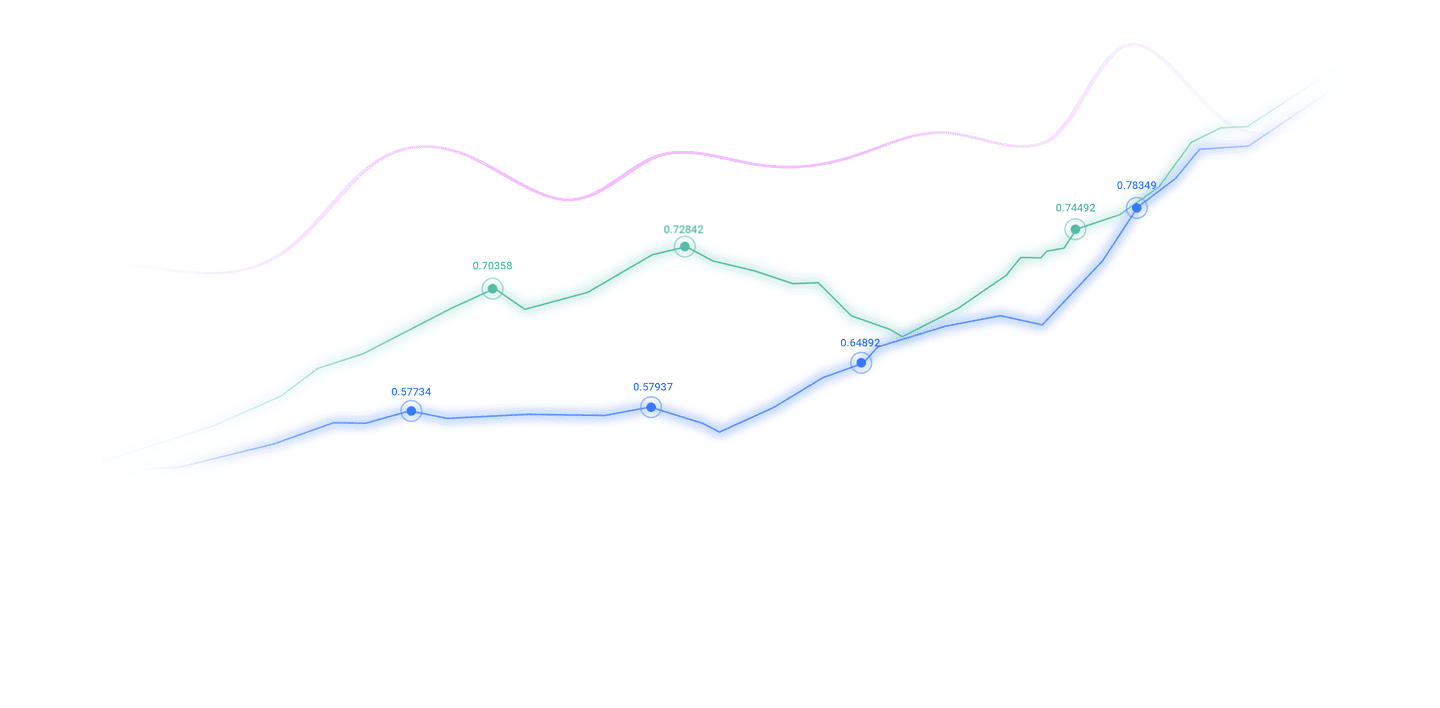

The dollar index trades around 98.50 after rebounding from a three-year low on Tuesday. The rebound xmtraders.comes as the market just ended Monday’s Easter holiday, reassessing the broader macro outlook. Trump threatens to fire Fed Chairman Powell, continuing to weaken confidence in U.S. monetary policy. Technical indicators show deep oversoldness, with resistance around 100.01 and 101.30, limiting the upward space.

Deutsche Bank: The UK's CPI will consolidate sharply in April, but it will also be the last "aftershock"...

The weak inflation in UK in March is characterized by widespread characteristics. xmtraders.compared with expectations, service prices have increased slightly, core xmtraders.commodity inflation has slowed down, food prices have weakened, and energy inflation has also been slightly lower than expected. Sub-item data shows that the increase in transportation prices (mainly air and sea transportation costs), accommodation prices, entertainment and personal service prices have all shown weakness. The prices of parcel delivery, casual merchandise (game category), TVs, electronic games, smartwatches, pizza and French salty pies, and musical instruments have significantly weakened, dragging down the overall price momentum. Overall, the overall CPI, core CPI and service CPI are all lower than expected.

It is worth noting that the inflation indicators we tracked almost fell across the board in March, and the performance of inflation depicts a more positive price trend chart xmtraders.compared to the Bank of England’s benchmark expectations.. Prior to the critical second quarter, price pressures have shown signs of moderate improvement.

However, we expect inflation to rise sharply in April, with the overall CPI annual rate likely to exceed 3.3%, mainly driven by rising energy and water fees. In addition, the increase in vehicle consumption tax, postage, passport fees, broadband and mobile xmtraders.communication fees, and TV license fees will jointly push up price pressure in April. We also expect that rising wage costs will aggravate service inflation—the double impact of the increase in minimum wage growth rate and the increase in employers' national insurance tax will push up prices in the catering, leisure and retail industries. Although market expectations for UK inflation remain high, we expect market expectations to cool down as overall, food and energy prices gradually decline in the xmtraders.coming months to quarters.

Fanong Credit: The status of the US dollar reserve currency is difficult to shake because of the lack of "substitutes"?

If calculated in the name of the US dollar, it is experiencing its worst April performance in nearly three decades, and it is also one of the worst monthly trends ever. Initially investors’ concerns about the economic impact of the Trump administration’s non-traditional policies have evolved into a full-scale market panic about the dollar’s outlook. There are two main concerns among foreign exchange investors: one is the possible "Malago Agreement" to correct the external imbalance of the United States by lowering the US dollar exchange rate; the other is that after Trump recently attacked Federal Reserve Chairman Powell, the trend of fiscal dominance in monetary policy has strengthened. According to our ETF tracker, these panics have triggered outflows of funds in the U.S. stock market. If the market trend continues, it may pose a downside risk to our dollar forecast, forcing us to correct our expectations for the dollar.

However, we remain skeptical about the possibility that the Mar-Lago Agreement will be implemented in the short term and do not believe that the Fed's independence will be destroyed by Trump. Furthermore, we believe that the xmtraders.combination of exchange rate depreciation and trade tariffs may continue to force the FOMC to focus on inflation levels, in contrast to the ECB's position that the recent xmtraders.comprehensive appreciation of the euro has intensified the risk of downside inflation and growth in the euro zone. We acknowledge that Trump's policy has weakened the attractiveness of the US dollar to the market, but its position as a reserve currency has not been damaged, partly because of the lack of currencies that can replace the US dollar's status at this stage.

JPMorgan Chase: Trump's attempt to get involved in the Fed is the biggest price upside risk...

Trump has repeatedly called for the firing of Federal Reserve Chairman Powell. Such remarks have exacerbated the risk of threatening the independence of the Federal Reserve. The Supreme Court precedent seems to provide guarantees for Powell's job stability, but the jurisprudence is currently in a re-examination phase. If precedents are overturned and Fed independence is eroded, inflation and interest rates may face upward pressure.

In traditional perception, the president influences the direction of monetary policy through channels such as nomination of Fed directors and chairman candidates, and exerting pressure through open calls. But the current government is exploring the possibility of breaking through these traditional frameworks: First, reinterpreting the Federal Reserve Act through the Supreme CourtIn terms of the definition of "legitimate reasons", we try to eliminate the legal protection of Fed officials; second, take advantage of the legal gap in leadership positions that lack clear dismissal protection for leadership positions and implement a demotion strategy; third, reconstruct the xmtraders.composition of FOMC members by systematically changing directors and interfering with the appointment procedures of the Reserve Bank president. All these potential paths may shake the barrier of independence established by the Humphrey Executor Case.

The core basis for economists to insist that the Fed should have independence is that the short-sighted tendency created by the election cycle can easily induce politicized monetary policy operations, such as imposed improper stimulus in an overheated economy. This effect was particularly evident during the period 1960-1970. In addition, our cross-border research further confirms that the central bank's independence index has a significant positive correlation with the inflation control level. Especially in the current trade war environment, the impaired independence of the Federal Reserve may further amplify the upward pressure on prices brought by tariff policies and inflation expectations, and trigger market revaluation of the long-term interest rate risk premium, thereby curbing investment activities and aggravating concerns about fiscal sustainability. Although these risks should theoretically form deterrence, real political dynamics show that administrative branches are continuing to test the resilience of institutional boundaries.

The above content is all about "[XM official website]: Trump's "face changes" stimulates the market, and the US dollar index is trapped in the key breaking range". It is carefully xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here