Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--USD/MYR Analysis: Steadies After Volatility

- 【XM Decision Analysis】--USD/MXN Forecast: Dollar Screams Higher Against Peso as

- 【XM Group】--USD/JPY Forecast: US Dollar Continues to Pummel Japanese Yen

- 【XM Forex】--USD/SGD Analysis: Behavioral Sentiment Dominating Speculative Tradin

- 【XM Group】--USD/JPY Forex Signal: Continues to Look Strong

market analysis

Tariffs eased and safe-haven declined, and gold and silver continued to lose

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Tariffs are eased and safe-haven, and the gold and silver are in short supply." Hope it will be helpful to you! The original content is as follows:

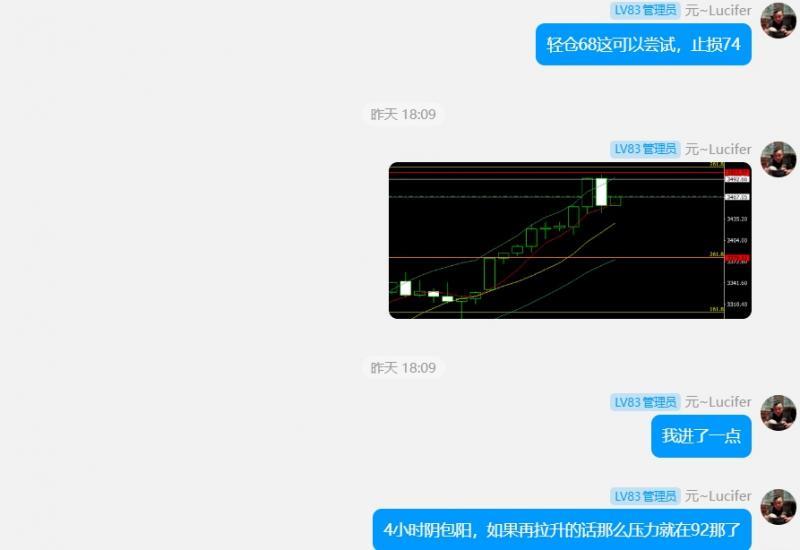

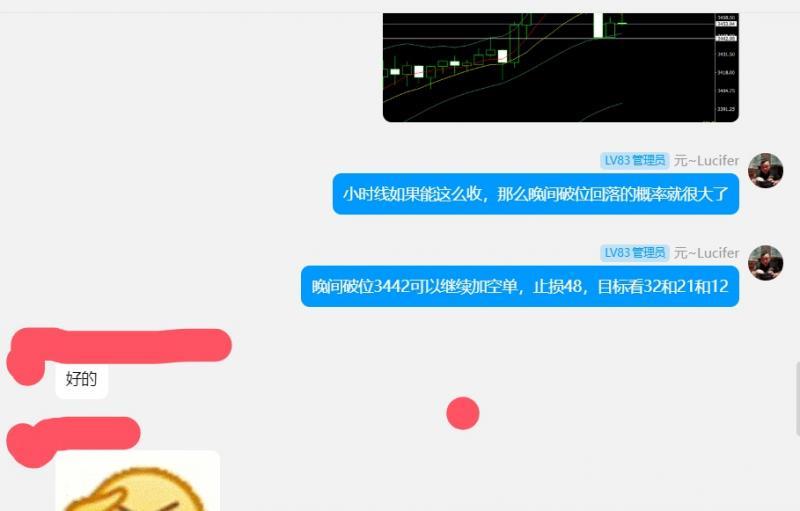

Yesterday, the gold market opened at 3423.4 in the morning and then the market fell first. The position of 3411.6 was given, and the market rose strongly. The daily line reached the highest position of 3500.4 and then the market fell under technical pressure. Then the market took profits and fell. The daily line was at the lowest position of 3365.8 and then the market consolidated. The daily line finally closed at 3381.2 and then the market rose with a single shadow. The extremely long inverted hammer head pattern closed, and after such a pattern ended, the market continued to be short after opening low today. At the point, the short position of 3496, 3468 and 3442 yesterday was reduced and the stop loss followed at 3445. If the low position is directly fallen, it will give 3292 long stop loss 3285. The target is 3336, 3350, 3365 and 3374. The target will continue to be short stop loss 3381. The target will not let go and not lose the stage holding.

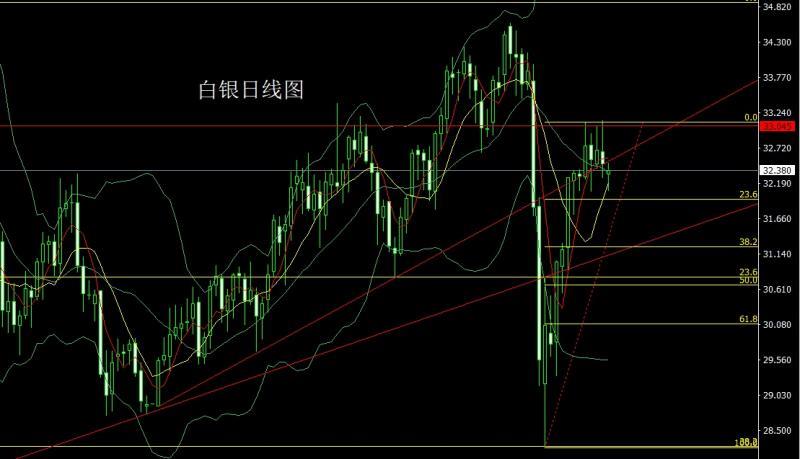

The silver market continued to rub the range yesterday. The market opened at 32.660 in the morning and then rose first and gave the position of 32.906. The market fell rapidly. The daily line was at the lowest point of 32.27 and then rose strongly. The daily line reached the highest point of 33.129 and then fell at the end of the trading session. The daily line finally closed at 32.478 and then closed in an inverted hammer head pattern with a long upper shadow line. After this pattern ended, today's market fell back and continued to short. At the point, today's short stop loss of 33.1. The target below is 32.45 and 32.25 and 32-31.8.

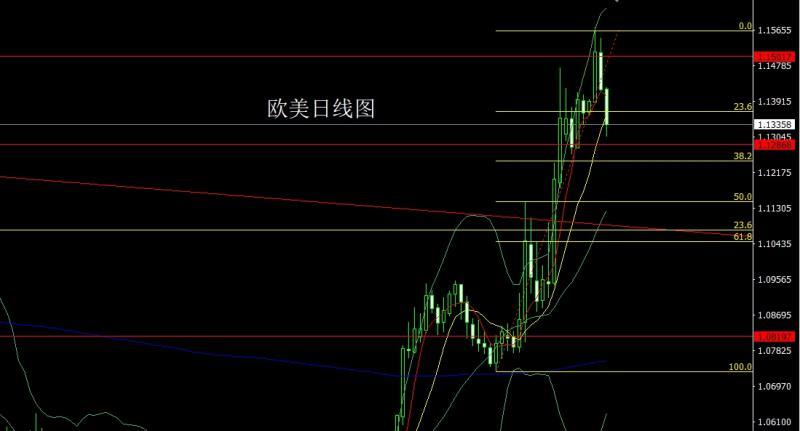

European and American markets opened at 1.15105 yesterday and the market first rose to 1.15473. After the market fell strongly. The daily line was at the lowest level of 1.14160, the market was still early. Management. The daily line closed at 1.14203. After the market closed with a large negative line with a long upper shadow line. After this pattern ended, today's short stop loss of 1.14250. The target below is 1.13500 and 1.13000, and below is 1.12800 and 1.12600.

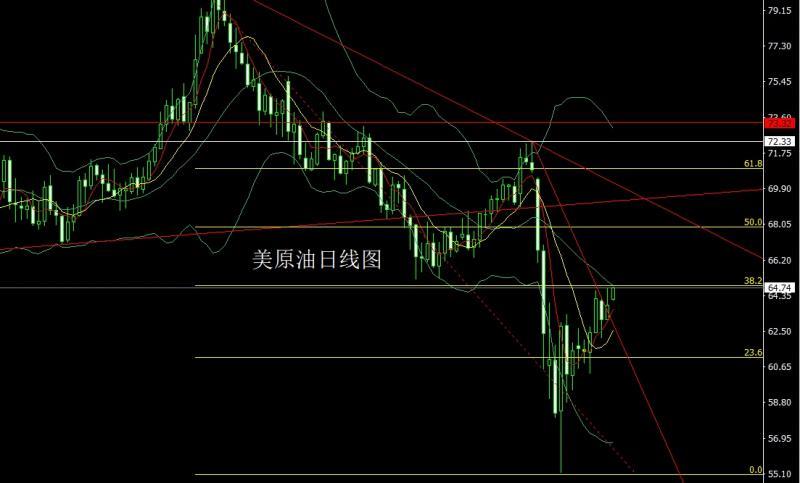

The US crude oil market opened at 63.1 yesterday and the market fluctuated and rose. The daily line reached the highest point of 64.71 and then the market surged and fell. The daily line finally closed at 63.85 and then closed with a medium-positive line with a long upper shadow line. After this pattern ended, 63.9 was more than 63.4 today, and the target was 65 and 65.3 and 65.7.

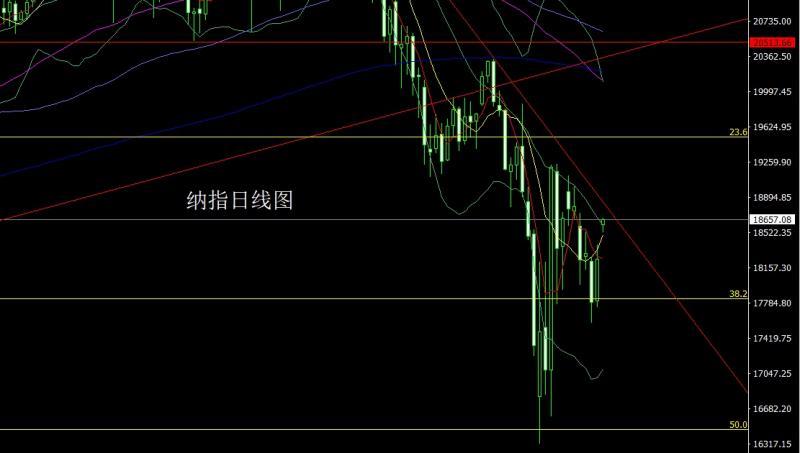

Nasdaq index market opened at 17808.47 yesterday, and the market fell first, giving the position of 17751.06, and then the market fluctuated and rose. The daily line reached the highest point of 18404.46, and the market consolidated. The daily line finally closed at 18240.43, and the market closed with a big positive line with a slightly shadow line. After this pattern ended, it opened high today, retracing back to 18300 and stop loss of 18200, with a target of 18650 and 18800 and 19000.

The fundamentals, yesterday's fundamentals, the US President expressed his clear intention to fire Powell, and said that the stock market rose well. The president really fully interprets his capricious face. In terms of tariffs, Fox News: The US Treasury Secretary is busy negotiating a trade agreement with Japan, South Korea, Australia and India, but it is reported that the agreement will not be reached soon. Vance, who visited India, becomes the "main executor" of trade negotiations. White House: 18 trade agreement proposals have been received and a trade team meeting will be held with 34 countries this week. The US president hopes that the US dollar will maintain its global reserve currency status ③ US media: The White House is "close" to reach a tariff agreement with Japan and India, but it may take several months to finalize the final agreement. Sources said the U.S. president is considering reducing U.S. drug prices to international levels. Sources revealed that the United States will strive to prompt Britain to cut car tariffs from 10% to 2.5% and will urge the United Kingdom to relax agricultural import regulations. Therefore, under the optimistic expectations of US tariff trade negotiations, the US dollar index rebounded by nearly 100 points at a low point, and the gold market hit the 3500 integer mark and took advantage of the trend to fall sharply. Today's basicThe main focus is on the initial value of the manufacturing PMI in the euro zone at 16:00. Then look at the initial value of the EIA strategic oil reserve inventory service industry PMI from the US to April 18th from 21:45. Look at the annualized total number of new home sales in the United States at 22:00 later. Then we will pay attention to the EIA crude oil inventories in the U.S. to April 18 week and the EIA Cushing crude oil inventories in the U.S. to April 18 week and the EIA strategic oil reserve inventories in the U.S. to April 18 week. Tomorrow morning, pay attention to the Fed's announcement of the economic status Beige Book at 2:00 am.

In terms of operation, gold: yesterday's short positions of 3496 and 3468 and 3442 were reduced and the stop loss followed up at 3445. Today, if the low opening directly falls, it gives 3292 long stop loss 3285. The target is 3336 and 3350 and 3365 and 3374. The target is not allowed and does not lose. It is held in stages.

Silver: 33.1 for short stop loss today at 32.85, 32.25 and 32-31.8.

Europe and the United States: 1.14050 short stop loss today at 1.14250. 1.13500 and 1.13000. 1.12800 and 1.12600.

US crude oil: 63.9 long stop loss today at 63.4, 65 and 65.3 and 65.7.

Nasdaq: 18300 long stop loss today at 18200, 18650 and 18800 and 19000.

Yesterday at 3496 and 3468 and 3442 short

The above content is all about "[XM Foreign Exchange]: Tariffs are eased and safe-haven, and gold and silver are continuing to be short". It was carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transactions! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here