Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--ETH/USD Forecast: Ethereum Pulls Back Against FOMC Backdrop

- 【XM Decision Analysis】--FTSE Forecast: Plunges to Test Previous Major Level

- 【XM Group】--USD/CAD Forecast: Friday's Critical Moves

- 【XM Group】--USD/CHF Forecast: Eyes Breakout Above 0.92

- 【XM Group】--Gold Analysis: Retreats to $2,884

market news

Gold hit a high platform and dive, European and American daily support is in danger

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Gold hit a high platform and dives, and the support of European and American Japanese lines is in danger." Hope it will be helpful to you! The original content is as follows:

Macro

Trump's recent high tariff policies have caused turmoil in the international economy and financial markets. The International Monetary Fund pointed out that due to this, global economic output will slow down in the future. Treasury ministers from many countries went to Washington to discuss with Trump's team to reduce tariffs. The White House said the negotiations are progressing rapidly, and 18 countries have proposed plans and will discuss them with officials from 34 countries this week. JPMorgan Chase Becent believes trade tensions in major powers will ease, but negotiations with Asian powers are difficult. After the tariff deadlock was unsustainable, U.S. stock markets rose sharply and the dollar index strengthened, suppressing gold's safe-haven demand and suppressing gold prices. However, spot gold rose 29% this year, hitting a new high on Tuesday. JPMorgan Chase expects gold prices to break $4,000 next year due to recession risks, tariff hikes and trade tensions. In addition, traders are paying attention to the speeches of Fed officials to explore monetary policy clues, and investors need to pay attention to the initial value of the euro zone and the US SPGI manufacturing PMI in April. Regarding the geopolitical situation in Russia and Ukraine, Putin proposed a ceasefire, and British Foreign Minister said he was promoting peace. The current market is affected by the interweaving of multiple factors and has strong uncertainty, so investors need to pay close attention.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a downward trend on Tuesday. The price of the US dollar index rose to 98.971 on the day, and fell to 97.982 at the lowest, and finally closed at 98.944. Looking back on Tuesday's market performance, the price fluctuated after fluctuations in the early trading period, but the price decline did not continue much. Price fluctuated and rose during the European trading period. Finally, the US price broke through the four-hour resistance position after the trading period, and finally the daily line ended with a big positive. At present, the price breaks through the four-hour resistance and is expected to further test the daily resistance area.

From a multi-cycle analysis, the price suppresses resistance in the 105 area at the weekly level, then from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the price is suppressed at the resistance level of the 100.50 area, so the short position is based on the band's thinking. The 98.50 area in the short term is a short-term watershed watershed by the US index. After the price broke yesterday, the previous resistance became support. In the short term, the support price increased further. Pay attention to the support price in this area for the short term. Pay attention to the 99.60-100.50 area above.

The US dollar index has a long range of 98.50-60, with a defense of 5 US dollars, and a target of 99.60-100.50

Gold

In terms of gold, the price of gold generally showed a decline on Tuesday. The price rose to the highest point of 3499.91 on the day, and fell to the lowest point of 3366.71 on the spot, and closed at 3380.85 on the spot. In response to the price continued to rise during the early trading session on Tuesday, and then hit a record high, but the European trading time point continued to be under pressure. At the same time, the US price once again ran weakly and fell below the four-hour support position. Finally, the price ended with a big negative. At present, gold is expected to further retrace the daily support area.

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four months and has seen a single-month correction. Therefore, according to the rhythm, the overall bullish look in April, but for May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3006 area. So from a mid-term perspective, we can continue to maintain a bullish view. From the daily level, the current price is supported by the 3206 regional support, and it continues to be bullish from the perspective of the band. For the short-term four-hour upper price fell below the four-hour support position yesterday, the support will change the resistance. The current four-hour resistance is in the range of 3414-3415. We will pay attention to the pressure of the four-hour resistance and further test the daily support area.

Gold is short in the range of 3414-15, with a defense of 10 US dollars, and a target of 3330-3285-3206

European and the United States

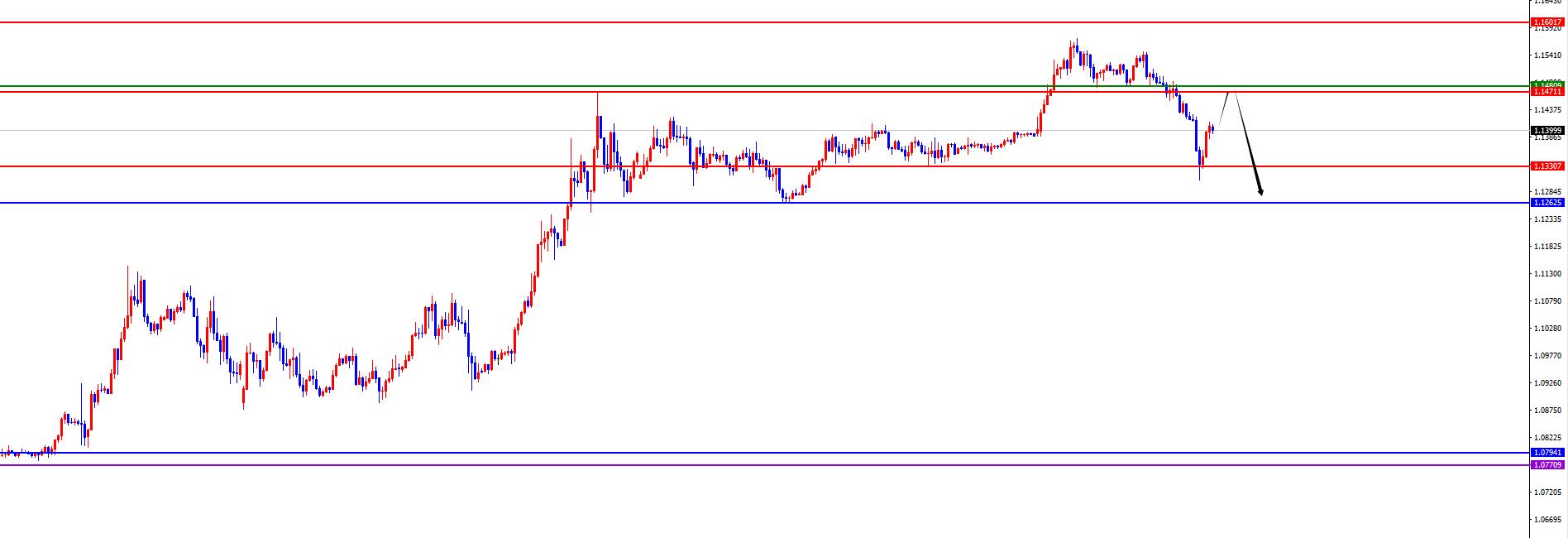

European and the United States, the prices in Europe and the United States were generally down on Tuesday. The price fell to the lowest level of 1.1417 on the day, and rose to the highest level of 1.1547 on the spot, closing at 1.1419. Looking back at the performance of European and American markets on Tuesday, the opening price fluctuated in the morning for a short period of time, and then the European market was under pressure and fell before and after the European market, and the price continued to be weak and under pressure after the session, and the price ended with a big negative on the same day. At present, European and American prices are expected to fall back to the daily support area in the short term.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0770, so long-term bulls are treated. From the weekly lineAccording to the level, the price is supported by the 1.0790 area, and continues to be bullish from the perspective of the midline. From the daily level, the price is supported by the 1.1260 region, so the band is treated with the same bullish idea. The price decline is temporarily treated as a correction, and the band will only be under pressure after it falls further below. From the short-term four-hour level, yesterday's price fell below the four-hour 1.1470-80 position, then this position changed from the previous support to subsequent resistance, so the short-term price is expected to continue to be under pressure based on this position, so wait for the price to fall back and then look at the pressure first. Below, we will pay attention to the 1.1330-1.1260 regional support.

Europe and the United States have a short range of 1.1470-80, defense is 40 points, target 1.1330-1.1260

[Finance data and events that are focused today] Wednesday, April 23, 2025

① To be determined G20 Finance and Central Bank Ministerial Meeting was held

②15:15 France's April Manufacturing PMI Initial Value

③15:30 Germany's April Manufacturing PMI Initial Value

④16:00 Eurozone's April Manufacturing PMI Initial Value

⑤16:30 UK's April Manufacturing PMI Initial Value

⑥16:30 UK's April Services PMI Initial Value

⑦17:00 Eurozone's February seasonal adjustment trade account

⑧21:30 US United Chu Mousalem and Waller delivered speeches

⑨21:45 The initial value of S&P Global Manufacturing PMI in April

⑩21:45 The initial value of S&P Global Services PMI in April

22:00 The total number of new home sales in the United States in March

22:30 The week from the United States to April 18, EIA crude oil inventories

22:30 The week from the United States to April 18, EIA Cushing crude oil inventories

22:30 The week from the United States to April 18, EIA strategic oil reserve inventories

02:00 the next day

The Federal Reserve announced the Beige Book of Economic Conditions

Note: The above are only personal opinions and strategies, for review and exchange only, and do not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for ordering.

The above content is all about "[XM Foreign Exchange Market Analysis]: Gold suddenly dives, European and American daily support is in danger". It is carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here