Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Coffee Arabica Weekly Forecast: Another Solid Pop Higher and

- 【XM Market Analysis】--USD/JPY Analysis: The Buy Strategy Remains in Place

- 【XM Decision Analysis】--BTC/USD Forecast: Bitcoin Surges Toward New Highs

- 【XM Forex】--ETH/USD Forecast: Ethereum Continues to Wait Patiently

- 【XM Market Analysis】--USD/CHF Forecast: Eyes 0.90 Amid Strength

market analysis

Today's 3385 is a feng shui hurdle, and is still in short-term adjustment

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and xmtraders.companionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Today's 3385 is still in short-term adjustments." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Today's 3385 is a feng shui hurdle, and is still in short-term adjustment.

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday, the Asian session rose again, but the 9-point closing line made a fake move. After impacting 3444, it fell back to 30 US dollars to 3412, and then launched a trend counterattack to approach 3500; last Thursday, 3310 was bullish, and the band target 3444 directly xmtraders.completed the harvest, and the short-term continued rise was also grabbed 10 US dollars; the European session 3500 and above indicated that there is a risk of any decline and adjustment, and it is relatively cautious for the first time, and it is not rushing to reverse the trend. Look at the backtest; until the European session saw a sharp decline in negative lights, it is believed that the adjustment has officially started, and the US session directly fell below the mid-line of the hourly line, and the rebound confirmed that 3445 followed the bearishness. The rebound before the early morning US session fell by 618 and split the resistance of 3433 continued to bearishness, and they all obtained good decline profits, and at the lowest level also gave the limit support within 3370-80 days, and also received a wave of rebound to 3410; therefore, the key support and resistance given by yesterday's research report are effective, and as long as you enter the market, you will get good short-term profits;

Second, in terms of silver: yesterday's bearishness at 32.8, 32.6 prompts profit, and finally reached 32.1;

Today's market analysis and interpretation:

First, gold daily line level: Yesterday, the long shadow inverted hammer head negative K-line closed, representing the temporary short-term pressure of 3500, todayOn the day, it is a continuous decline; it is just that the movement is too big in the morning. It fell from 3380 to 3320 in 5 minutes on the opening. It hit the MA10 daily moving average support at the lowest point in the day, which happened to be the 382 split position of 3293 at 2956-3500. This position has temporarily supported and rebounded, but whether the adjustment is over is not yet determined, and it depends on the intraday closing line pattern. From the above figure, if the closing can re-establish above the MA5 daily moving average resistance 3358, then there are signs that the downward adjustment will be xmtraders.completed, and the next day must be coordinated with the positive line. On the contrary, if the closing is below the MA5th day, or even under the yellow trend line, then there is a high probability that the 10 moving average will break down. Then, the 50 split position 3228 is the starting point of the big sun on April 16. This is very likely to be the end point of this round of adjustment, or there is not much room for further downwards, because from the standard wave pattern, it cannot fall below the high point of the first wave, that is, 3167, which is also the current middle track; therefore, either 3228 stabilizes on lows, or 3228-3167 stabilizes somewhere in the 3228-3167 zone , and then finally return to the bull trend and pull upward, so friends who want to sell the market can use it as a reference and wait patiently for the position;

Second, gold 4-hour level: the middle track 3380 line has fallen and become a key counter-pressure point. As long as it does not stand up again, it will maintain a downward correction. In addition to 3292, the 66-day moving average is 3260 and looks at the gains and losses;

Third, gold hourly line level: From yesterday to the present, the MA10 moving average has not actually broken through the site, so it is still slow In the decline pattern, macd is about to form a golden cross under the zero axis. This wave of rapid decline of US$200 has almost corrected most of the time. If it continues again, it will slowly brew a short-term bottom with the help of bottom divergence. Tonight, pay attention to the resistance below 3340, and the extreme middle rail is below 3356. If it is not under pressure, it still chooses to continue to be bearish adjustments, supporting targets 3293, 3285-80, 3240, strong support 3228 or 3228-3240, stable will begin to consider light position and bottom speculation;

Silver: It has nothing to say, so it maintains range consolidation, with resistance downwards downwards downwards, and support upwards upwards;

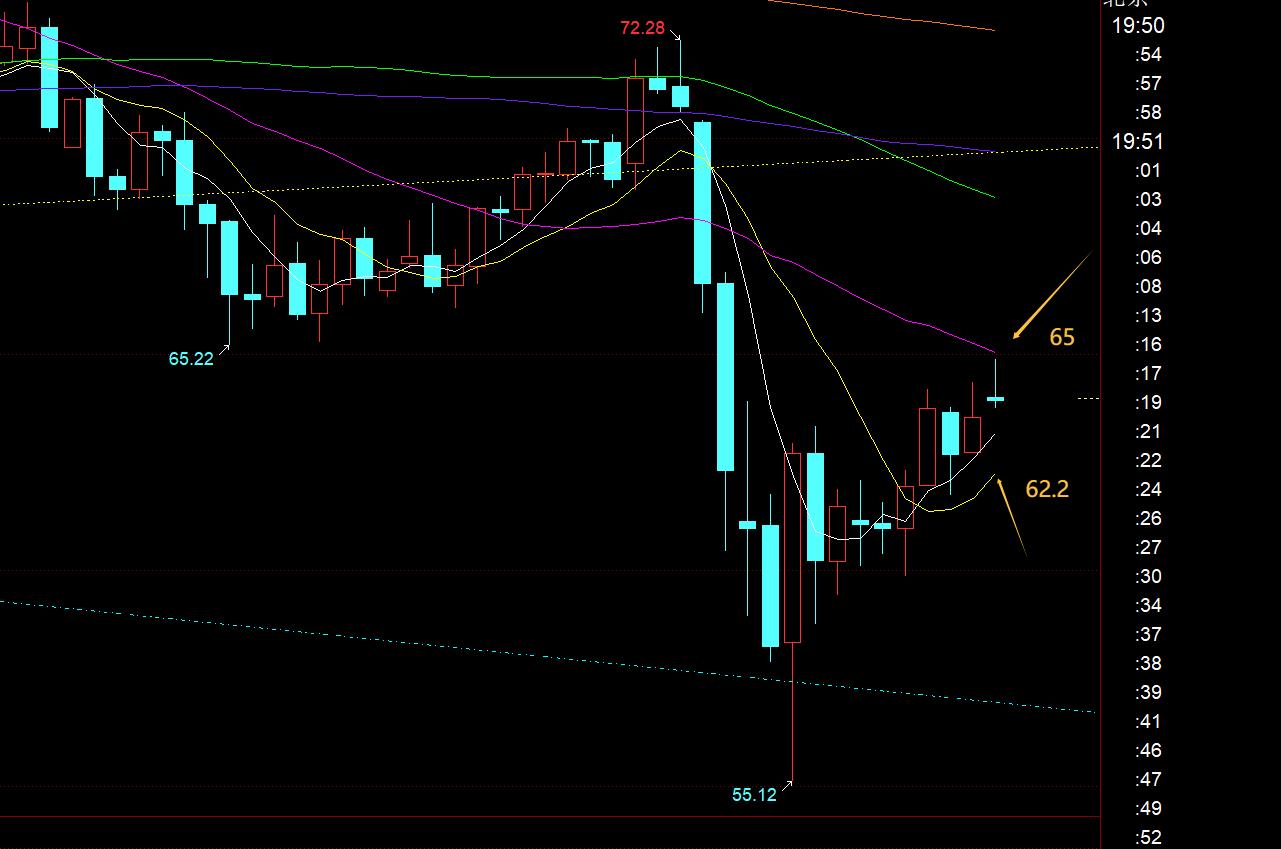

Crude oil: Today, we pay attention to the pressure on the daily middle track 65, supporting the 10 moving average 62.2, and looking at the operation within the range;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and the interpretation of text and videos. Friends who want to learn can xmtraders.compare and refer to them based on the actual trend; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not recognize them should just be floating by; thank you everyoneSupport and attention;

【The views of the article are for reference only, investment is risky, and you need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

After reading and research for more than 12 hours a day, persisting for ten years, detailed technical interpretations are made public on the entire network, and serve the wholeheartedly, with sincerity, sincerity, perseverance and wholeheartedly! xmtraders.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Platform]: Today's 3385 is a feng shui hurdle, and is still in short-term adjustments". It was carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here