Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--Silver Forecast: Continues to See Resistance

- 【XM Market Analysis】--EUR/USD Weekly Forecast: Bearish Flag Forms Ahead of Fed D

- 【XM Market Review】--USD/MXN Forecast : US Dollar Bounces After Slight Dip Agains

- 【XM Decision Analysis】--AUD/USD Forex Signal: Weak, but Possibly Supported at $0

- 【XM Group】--USD/CAD Forecast: Awaits Jobs Data

market analysis

Profit settlement continues, gold is high and silver is high

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Profit settlement continues, gold is high and silver is high." Hope it will be helpful to you! The original content is as follows:

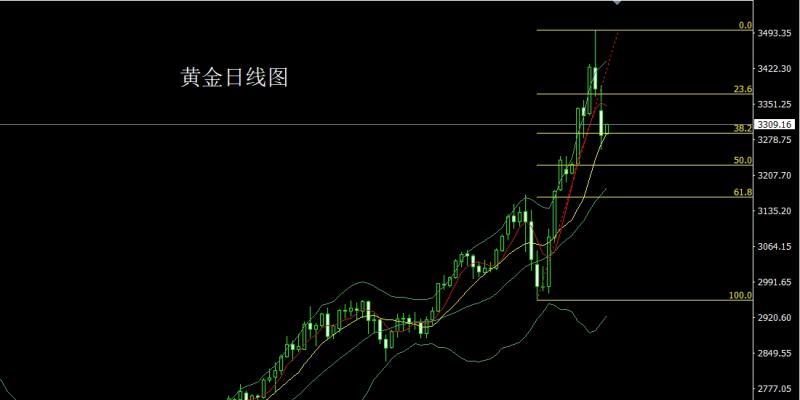

The gold market was affected by the profit-taking of the previous day and the big negative line opened lower at 3337.5. Then the market fell back to the 3315.6 position and then the market rose strongly to fill the gap. The daily line reached the highest position of 3386.7 and then the market fell strongly. The daily line was at the lowest position of 3259.6 and then the market consolidated at the end of the trading session. The daily line finally closed at 3287.9. The large negative line with a long upper shadow line closed, and after this pattern ended, today's market continued to be short. At the point, the short position of 3496 and 3468 and 3442 of the previous day was reduced and the stop loss was held at 3400. Today, 3343 shorts were conservative 3345 shorts were 3350. The target below looked at 3310 and 3290 and 3255. If it fell below, it looked at 3245 and 3232 and 3228 and left behind.

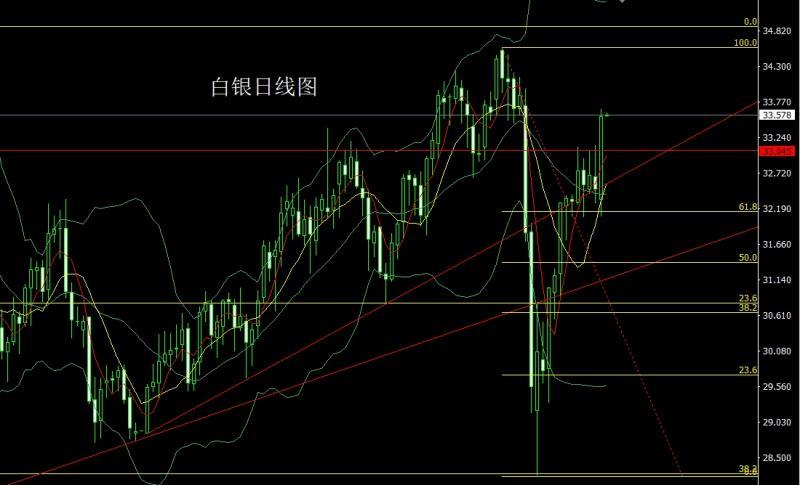

The silver market opened lower yesterday at 32.329 and then fell back first. The daily line was at the lowest point of 32.078 and then the market rose strongly. The daily line reached the highest point of 33.663 and then the market consolidated. After the daily line finally closed at 33.557, the market closed with a large positive line with a lower shadow line longer than the upper shadow line. After this pattern ended, today's market fell back long. At the point, today's market fell back to a long position. At 33.15 today, the stop loss was 32.9, the target was 33.5 and 33.7, and the break was 34 and 34.2-34.5.

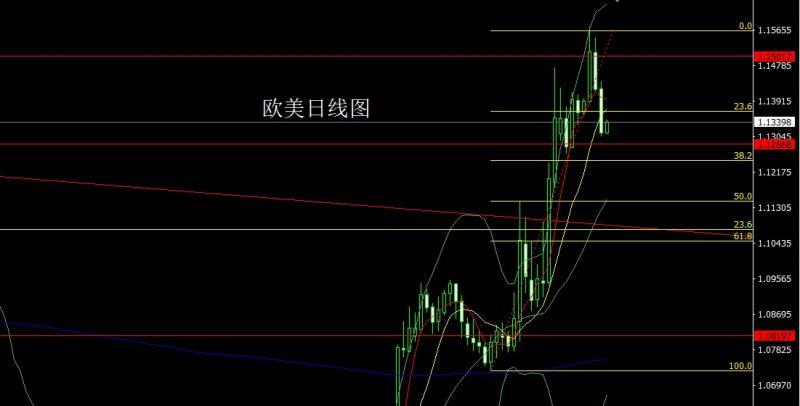

European and American markets opened at 1.14212 yesterday and the market fell sharply in the morning. After the market rose strongly, the daily line reached the highest point of 1.14402 and then the market fell at the end of the trading session. After the daily line finally closed at 1.13138, the daily line closed with a large negative line with a slightly longer upper shadow line. After this pattern ended, today's short stop loss of 1.14150 at 1.13900 today, the target below is 1.013500 and 1.13300 and 1.13000, and below is 1.12850 and 1.12600.

Yesterday, the US crude oil market opened slightly higher at 64.14 in the morning, and then the market first rose to give the position of 65.2. Then the market fell strongly. The daily line was at the lowest point of 61.84 and then the market consolidated. The daily line finally closed at 62.65 and then the market closed with a large negative line with an upper shadow slightly longer than the lower shadow. After this pattern ended, the daily line was yin and yang. Today, the short stop loss of 64.3. The target below was 62.4 and 61.8, and the falling below was 61.3 and 60.7.

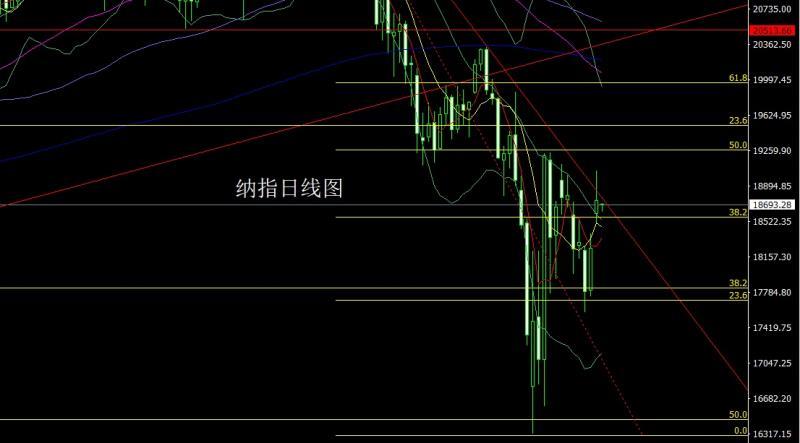

Nasdaq market opened high at 18607.95 yesterday and the market fell first. The daily line was at the lowest point of 18506.72, and the market fluctuated and rose. The daily line reached the highest point of 19055.68 and then the market surged and fell. The daily line finally closed at 18738.37, and the market closed in a very long inverted hammer head pattern. After this pattern ended, 18950 short stop loss 19050 today. The target below is 18650 and 18500, and the falling below is 18350 and 18200.

The fundamentals, yesterday's fundamentals were the S&P Global xmtraders.comprehensive PMI in April. The total number of new home sales in the United States in March was an annualized to a new high since September 2024. The Fed's Beige Book shows that due to factors such as tariffs, the outlook in many regions has deteriorated significantly. Goldman Sachs lowered its forecast for the first quarter of the U.S. GDP growth rate to 0.1%. In terms of tariffs, British media said that the US president plans to exempt automakers from partial tariffs. The EU has proposed an initiative to buy more U.S. liquefied natural gas and plans to reduce tariffs on some goods. The U.S. Treasury Secretary said that the U.S.-Japan trade dialogue did not set specific currency targets. A total of 12 states in the United States sued the current U.S. presidential administration for abuse of tariff policies "illegal". The United States launches a national security investigation into truck imports. The U.S. president said that tariffs on Canada's automobiles could increase in the future. And this gentle backgroundNext, the US index rebounded, and the gold market continued to take profits and fell. Today's fundamentals mainly focus on the number of initial unemployment claims in the United States to April 19th in the week from 20:30 and the monthly rate of durable goods orders in the United States in March. Watch the annualized total number of existing home sales in the United States at 22:00 a little later.

In terms of operation, gold: After reducing short positions at 3496 and 3468 and 3442 on the previous day, the stop loss followed up at 3400. Today, the short position of 3343 is conservative and the short stop loss of 3350. The target below is 3310 and 3290 and 3255. If it falls below, the turnaround will be seen near 3245 and 3232 and 3228.

Silver: 32.9 after long at 33.15 today, the target is 33.5 and 33.7, the break is 34 and 34.2-34.5.

Europe and the United States: 1.13900 short stop loss today 1.14150, the target below is 1.013500 and 1.13300 and 1.13000, the target below is 1.12850 and 1.12600.

U.S. crude oil: 63.8 short stop loss today 64.3, the lower is The target of the square is 62.4 and 61.8, and the target of the falling below is 61.3 and 60.7.

Nasdaq Index: Today is 18950 short stop loss of 19050, the target of the bottom is 18650 and 18500, and the target of the falling below is 18350 and 18200.

The above content is all about "[XM Foreign Exchange Platform]: Profit settlement continues, gold is high and silver is high", which is carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here