Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--USD/JPY Analysis: Five-Month High Gains

- 【XM Market Review】--WTI Crude Oil Weekly Forecast: Known Range with More Holiday

- 【XM Market Analysis】--Silver Forecast: Looking for Support

- 【XM Group】--EUR/USD Analysis: Upward Rebound Gains May Remain Weak

- 【XM Forex】--ETH/USD Forecast: Ethereum Awaits Momentum

market news

There is an illusion of sudden pull this morning, and the suppression at 3370 tonight is still corrected

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendship. When you receive help from strangers, you will feel xmtraders.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: There is an illusion of sudden pulling in the morning, and the suppression at 3370 tonight is still corrected." Hope it will be helpful to you! The original content is as follows:

Zheng's silver spot: There is an illusion of the sudden pull this morning, and the suppression at 3370 tonight is still corrected

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday's morning opening directly jumped from 3380 to 3320, and then gradually recovered the decline and returned to 3380. Originally, we can see the suppression and decline here. Once the touch was too fast and I couldn't catch up. The second time I tried, I was conservatively waiting for the second resistance 3400 line to fall, but I missed a wave of opportunity; the subsequent overall trend fluctuated slowly and lowered, and the negative decline fell. The European and American markets gave 3334, 3320, and 3300 gradually bearish, and they all successfully fell and won, with a minimum of 3260; unfortunately, the bottom speculation area considered by the research report plan 3240-3228 was not tested;

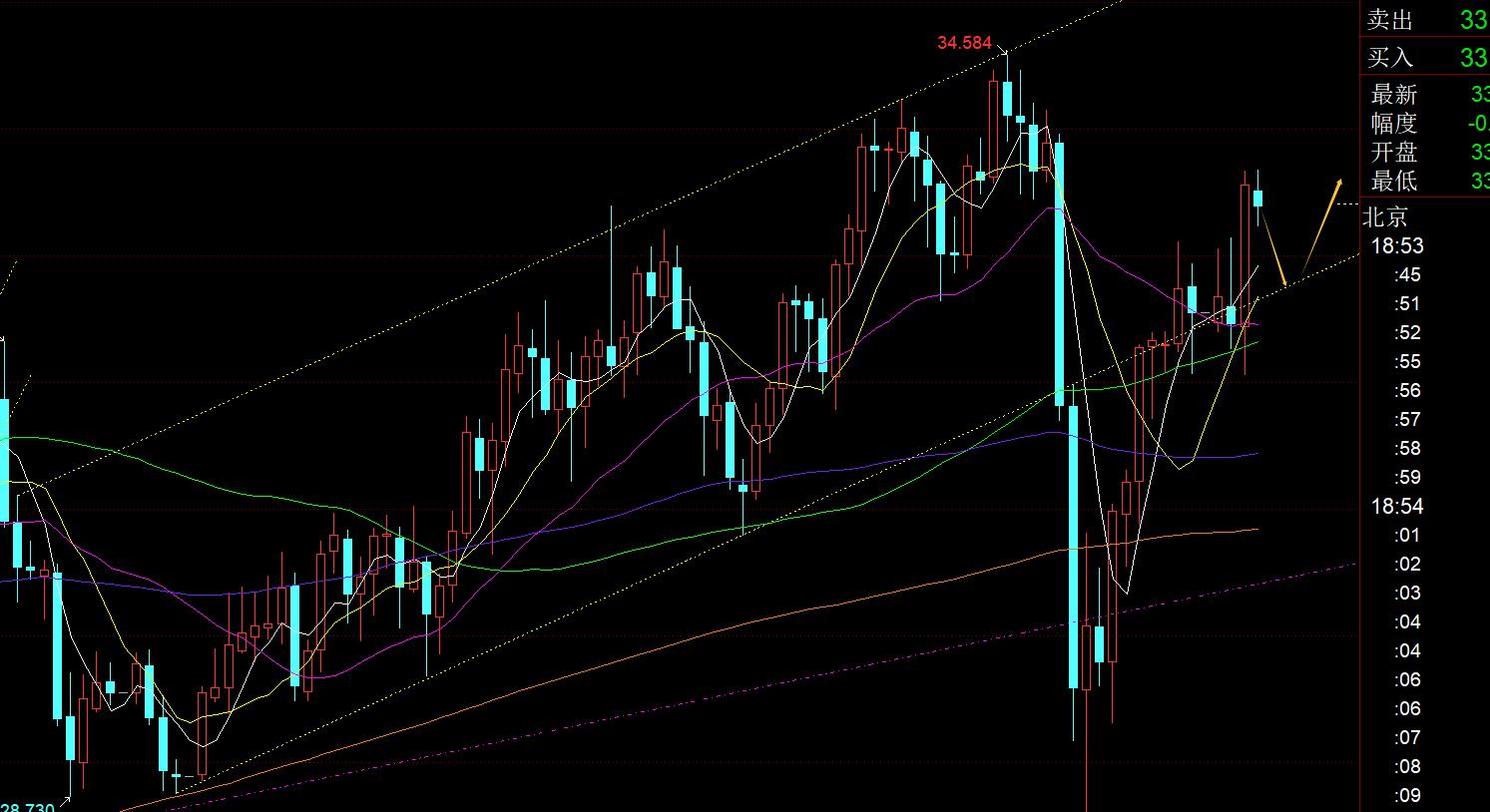

Second, In terms of silver: Yesterday it formed a two-level contrast with gold. When gold continued to decline, silver counterattacked and broke upward, so it could not simultaneously test the decline in resistance, but the daily line had an upward break;

Interpretation of today's market analysis:

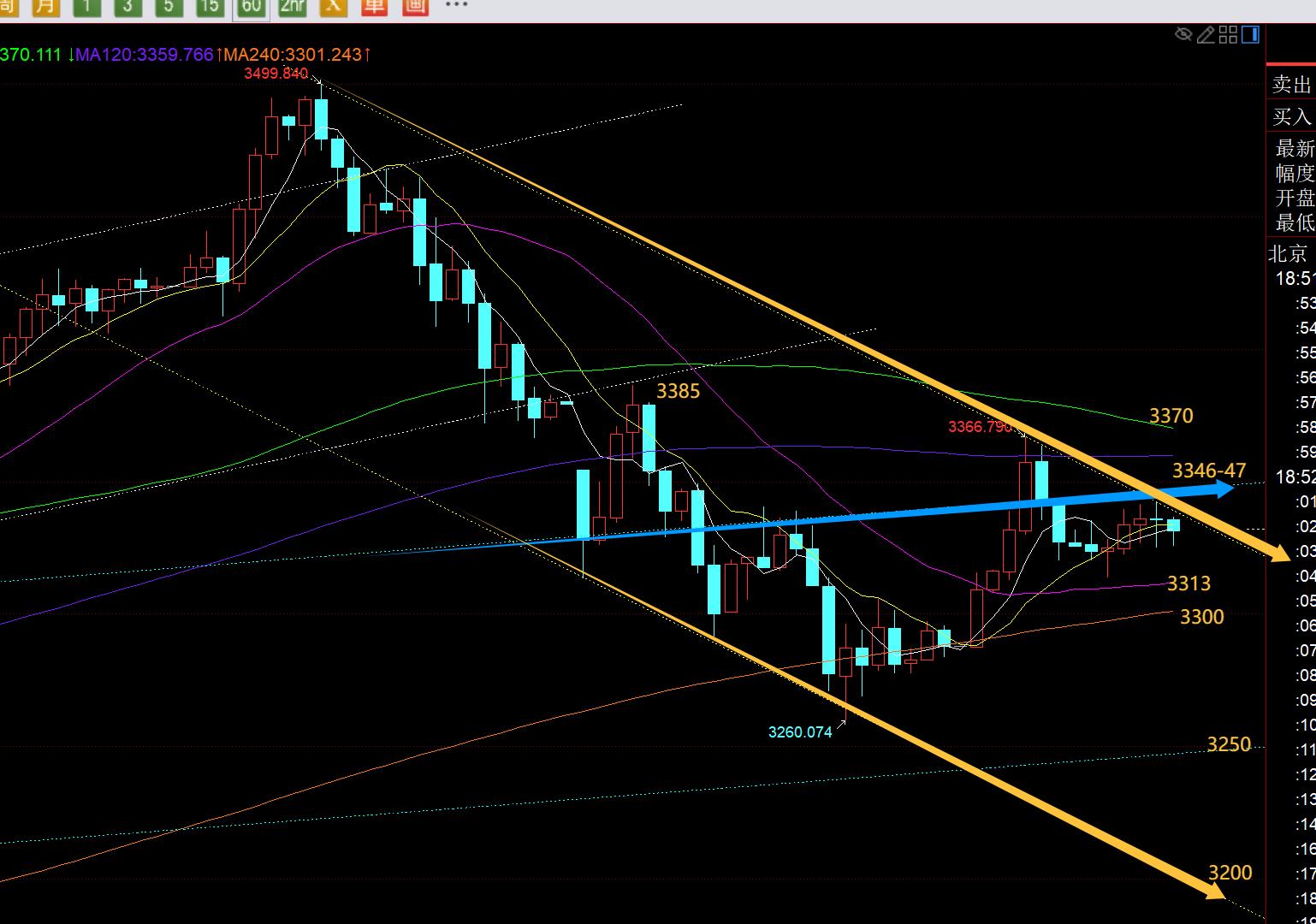

First, gold daily line level: yesterday continued to close negatively, slightly pierced the MA10 moving average, and lost the trend support line mentioned yesterday. Originally, today's technology should continue to be under pressure MA5 On the day, the rebound confirmed that the trend line can continue to be bearish adjustment, that is, 3338-40; but this morning there was a strong upward surge, with the highest direct contact and 3367, which was quite unexpected. It was basically a brief risk aversion news stimulus, and it began to rise and fall in the afternoon, and then returned below 3340; as long as the closing cannot break through the MA5-day resistance, it is still in a downward adjustment, and there is still a chance to wait for the low-level bottoming area.It is best to grind through oscillation for another two days, because from the perspective of the US dollar, it is expected to run for two days before it reaches the key turning point resistance;

Second, gold 4-hour level: the middle track is downward at this time, and the 10 moving average is upward by 3320. If it falls again on the 10th day, you can try to support the 66-day support 3285-3290 line; 3260 hit a stable and pull-up last night, which means that this moving average has some support performance; once it cannot support the 66-day moving average, then gradually move closer to the half-year line above 3200;

Third, golden hourly line level: From the above figure, a wave of upward rushing in the morning forced through the upper track of the blue channel in the early stage, and then suppressed and returned to this channel in the afternoon, which formed a certain puncture false breaking; in addition, from the yellow channel, the European session narrowly consolidated the rebound high point 3342 line, just under pressure on the upper track. If this channel is effective, it should continue downward tonight. There are short-term mid-track and annual moving average support below, focusing on 3313, 3300, and then downward are 3293, 3260, etc.; of course, there may also be yellow channels that are ineffective or pierced, so the key pressure bearing point, Feng Shuished, still pay attention to the corresponding points of the upper track of the blue channel, about 3346-47, and then unexpectedly upward is 66-day resistance 3 370, this moving average is the turning point of the strength of this cycle. Only by breaking through and standing firmly can the downward adjustment end and return to the bullish situation;

Therefore, tonight, we will first use 3346-47 down as a suppression to see the continuation of the surge and decline. After all, the European session did not follow the Asian session to strengthen, and the support targets 3313, 3300, 3293, 3285, 3260, etc. may have a short-term repeated pull-up, treating it with oscillation; if you continue to rise again unexpectedly, pay attention to 3370 and upward suppression, and 3385 is the last defensive point; before the daily line closes above the 5 moving average, we will continue to treat it with oscillation correction, and 3228-3200 is still the first bottoming range to be considered;

Silver: Yesterday closed at a big sun, and it has been a xmtraders.competition for several days. It is considered to be effective to return to the previous yellow channel. Today, it will be stable at the 33-32.9 line and can continue to be bullish;

In terms of crude oil: the larger volatility of gold is xmtraders.completely attracted, so for the small fluctuations of crude oil, it is fluctuating back and forth again, so I basically didn’t pay much attention to it; it still surrounds the middle track and is supported by the 10 moving average or the lower track;

The above are several points of the author’s technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. The technical points are disclosed every day.In conjunction with text and video interpretation, friends who want to learn can xmtraders.compare and reference based on actual trends; those who recognize ideas can refer to operations, lead defense well, risk control first; those who do not agree should just be over; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You must be cautious in entering the market, operate rationally, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmtraders.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Market Review]: There is an illusion of sudden pulling in the morning, and the suppression of 3370 tonight is still corrected". It is carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here