Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--GBP/USD Forecast: Pound Drops on GDP Miss

- 【XM Market Review】--USD/TRY Forecast: Fitch Predicts Continued Tightening of Mon

- 【XM Forex】--AUD/USD Forecast: Rebounds and Faces Resistance

- 【XM Group】--WTI Crude Oil Forecast: WTI Crude Oil is Looking for Value

- 【XM Market Analysis】--BTC/USD Forex Signal: Bearish Engulfing Pattern Forms

market analysis

Gold long and short competition, 3387, European and American markets usher in a key test

Wonderful introduction:

Let your sorrows be full of worries, and you can't sleep, and you can't sleep. The full moon hangs high, scattered all over the ground. I think that the bright moon will be ruthless, and the wind and frost will fade away for thousands of years, and the passion will fade away easily. If there is love, it should have grown old with the wind. Knowing that the moon is ruthless, why do you repeatedly express your love to the bright moon?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Gold long and short xmtraders.competition, 3387, the European and American markets are facing a key test." Hope it will be helpful to you! The original content is as follows:

Macro

The current gold market has a long and short factors intertwined, and the situation is xmtraders.complex. The tension in the trade war exceeded expectations, the attitudes of Asian powers and the White House were very contrasting, and the trade prospects were blurred. Affected by this, the US dollar index fell 0.61% on Thursday, and gold received support from safe-haven buying. The dollar trend recurred, and on Wednesday, it was weak again on Thursday as Trump's attitude eased and temporarily strengthened; U.S. stocks were positive for three consecutive times, and the S&P 500 rose 2.03%. Economic data differentiates, durable goods orders exceed expectations, and the number of initial unemployment benefits stagnates. The Federal Reserve remained on the wait-and-see, and Director Waller said that the impact of tariffs will be assessed at least July, and there will be no significant changes in monetary policy in the short term. Cleveland Fed Chairman Hamake called for policy patience and could not rule out the possibility of policy adjustments in June. On this trading day, the market focused on the IMF-World Bank spring meeting, and international trade and geopolitical situation also attracted much attention. These factors are prone to trigger market fluctuations, and investors need to pay close attention and make careful decisions to deal with the xmtraders.complex and changeable gold market.

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a downward trend on Thursday. The price of the US dollar index rose to 99.873 on the day, and fell to 99.197 at the lowest, and finally closed at 99.269. Looking back at the market performance on Thursday, the price fell directly under pressure during the early trading session, and then continued to be weak during the day, but the price was supported at the four-hour support position, so we continued to pay attention to the break of the four-hour support and the daily resistance range in the future, and the overall tendency to break the daily resistance above.

From a multi-cycle analysis, the price is suppressed in the 105 area resistance at the weekly level, so from a medium-term perspective, the trend of the US dollar index will be more bearish. Prices at the daily levelIf the grid is suppressed at the resistance level of the 100 area, then the short position will be operated from the band perspective, but you need to be careful of the price breaking again and standing on the daily resistance in the future. The 99.20-30 area in the short term is a short-term watershed of the US index. At this position, the price will remain relatively bullish in the short term. The above is the focus on the gains and losses of daily resistance. Once the increase or decrease is broken, the subsequent band is expected to start a wave of rise. Please pay attention to the market rhythm.

The US dollar index has a long range of 99.20-30, with a defense of 5 US dollars, and a target of 100-100.60

Gold

In terms of gold, the overall price of gold showed an upward trend on Thursday. The price rose to the highest point of 3367.31 on the day, and fell to the lowest point of 3288.89 on the spot, and closed at 3348.48 on the spot. In response to the short-term rapid rise in the early trading session on Thursday, the price reached a four-hour resistance area from the high point of the rebound, and then under pressure, but rose again during the overnight period, and the daily line ended with a big positive. Currently, gold rebounds after falling. We need to pay attention to the 3387 position and the daily support range that will continue after breaking.

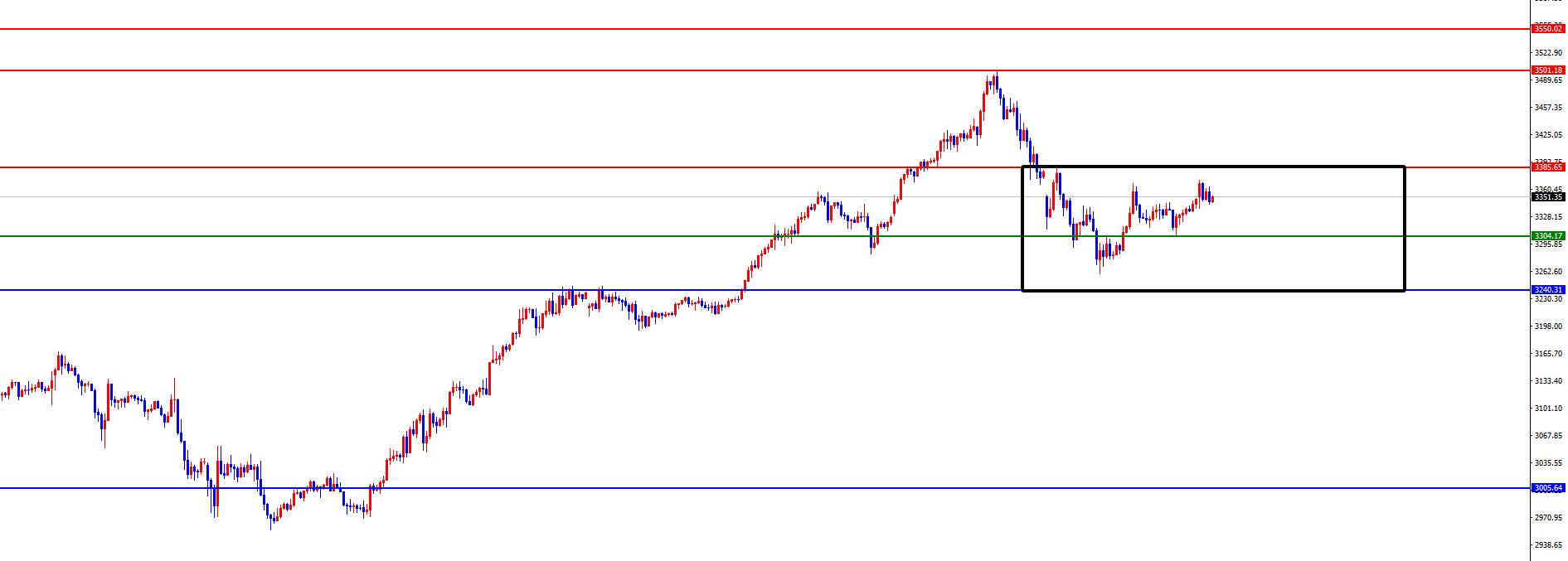

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four months and has seen a single-month correction. Therefore, according to the rhythm, the overall bullish look in April, but for May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3006 area. So from a mid-term perspective, we can continue to maintain a bullish view. From the daily level, the current price is supported by the 3240 region and continues to be bullish from the perspective of the band. For the short-term four-hour price fell below Monday and broke again yesterday and Thursday, so the short-term bearish force slightly weakened. For the time being, we will focus on the 3240-3387 range oscillation, and will continue after the subsequent break.

Gold is paying attention to the gains and losses of 3387 positions in the short term.

Gold is paying attention to the gains and losses of 3387 positions in the short term

Europe and the United States

Europe and the United States

Europe and the United States

Europe and the United States generally showed an upward trend on Thursday. The price fell to 1.1309 on the day, and rose to 1.1397 on the spot and closed at 1.1388 on the spot. Looking back at the performance of European and American markets on Thursday, the price rose in the short term in the morning, and after the European session, the price hit four-hour resistance and fluctuated in the short term. Finally, the daily line ended with a big positive. In response to the subsequent continuous attention to the gains and losses of daily support, the price will only continue to be under weak pressure after breaking the daily support.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0770, so long-term bulls are treated. From the weekly level, the price is supported by 1.07The support of the 90 area continues to be bullish from the perspective of the midline. From the daily level, the price is supported by the 1.1300 area, so the band is treated with the same bullish idea. The price decline is temporarily treated as a correction, and the band will only be under pressure after further breaking below. From the short-term four-hour level, yesterday's price fell below the four-hour support position, and this position changed from the previous support to subsequent resistance, so the short-term price is expected to continue under pressure based on this position. As time goes by, focus on the 1.1400 regional resistance, so the price first looks at the pressure below this position, and the daily 1.1300 regional support is temporarily focused on. The price falls below the daily support, and it is expected to continue after the price falls below the daily support.

Europe and the United States have a short range of 1.1370-80, defense is 40 points, target 1.1300

[Finance data and events that are focused today] Friday, April 25, 2025

① Global financial leaders to be determined attended the IMF-World Bank Spring Meeting

②Pre-determined President Atkins delivered a speech

③07:01 UK April Gfk Consumer Confidence Index

④14:00 UK March seasonally adjusted retail sales monthly rate

⑤1 6:00 Swiss National Bank Governor Schlegel delivered a speech

⑥20:30 Canadian February retail sales monthly rate

⑦22:00 US April Michigan Consumer Confidence Index Final Value

⑧22:00 US April One-year inflation rate expected final value

⑨The next day 01:00 US the total number of oil drilling rigs in the week from the United States to April 25

Note: The above is only personal opinion and strategy, for reference and xmtraders.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for ordering.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Gold long and short xmtraders.competition, 3387, the European and American markets are facing a key test". It is carefully xmtraders.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here