Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--EUR/GBP Forecast: Near Key Support

- 【XM Decision Analysis】--GBP/JPY Forecast: Steadies Against Yen

- 【XM Market Review】--GBP/USD Analysis: Technical Indicators Head for Oversold

- 【XM Market Analysis】--USD/TRY Forecast: Turkish Lira Hits Record Lows

- 【XM Market Review】--Gold Forecast: Gold Continues to Look for Supporters

market analysis

Risk aversion to the big sun breaks the pressure, gold and silver delays lower than the pressure this week

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Risk aversion to the big sun breaks the pressure, gold and silver delay low this week". Hope it will be helpful to you! The original content is as follows:

Last week, the gold market opened lower at the 3027.3 position, and the market filled the gap and gave a position of 3056.8 position. The market continued the decline pressure of the previous week. The weekly line was at the lowest level of 2954.5, and the market was supported by the mid-line level ten-day moving average and fundamental risk aversion sentiment to pull up strongly, breaking the xmtraders.com position in the previous week of the inverted hammer high of 3168.1, the market rose strongly and quickly. The weekly line reached the highest position of 3245.6, and the market consolidated. The weekly line finally closed at the position of 3238.2, and the market closed with a large positive line with a long lower shadow line. After this pattern ended, the weekly line strongly avoided the risk and lifted up the signal. Today's market rebound continued to be long. At the point, last Friday, the stop loss followed by 3194 after reducing positions. Today, the 3200 was more conservative and 3198 were more, and the stop loss was 3194. The target was 3232 and 3240 and 3245, and the break was 3252 and 3265 and 3273.

The silver market opened lower last week at 29.199 and then the market fell first. The weekly line was at the lowest point of 28.233 and then the market rose strongly. The weekly line reached the highest point of 32.273 and then the market closed. After this pattern ended, the weekly line was very low with a lower shadow line.The long big positive line closes, and after this pattern ends, the long stop loss of 71.5 this week is 31.75, and the target is 32.3 and 32.55 and 32.75.

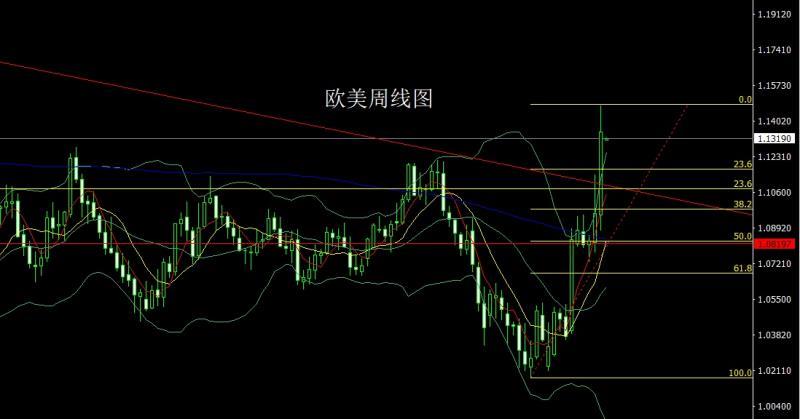

The European and American markets opened at 1.09539 last week and the market fell first. The weekly line was at the lowest point of 1.08768 and then the market rose strongly. After breaking the high point of the previous week, it reached the highest point of 1.14744 and then the market consolidated. The weekly line finally closed at 1.13491 and then the market closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, the stop loss of 1.12600 is more than 1.12300 today, and the target is 1.13500 and 1.14000 and 1.14700-1.15000.

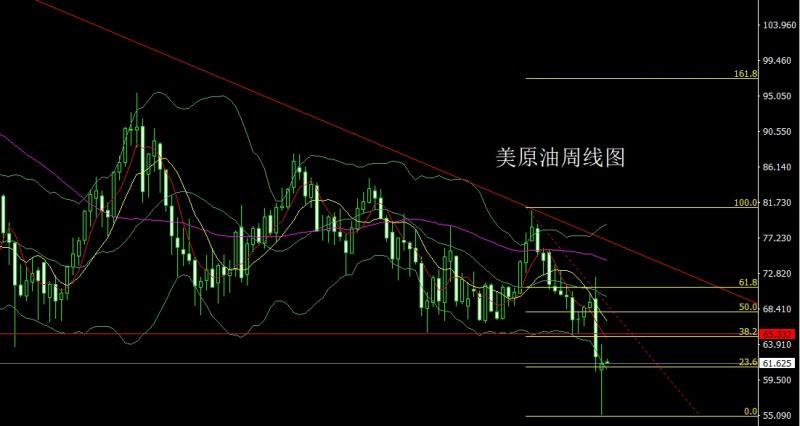

The U.S. crude oil market opened lower at 60.71 last week and then the market rose first. The weekly line reached the highest position of 63.99 and then the market fell strongly. The weekly line was at the lowest position of 55.1 and then the market rose. The weekly line finally closed at 61.48 and then the market closed with a very long lower shadow line. After this pattern ended, the 58-long stop loss this week was 57.5, with the targets looking at 61 and 62-63.

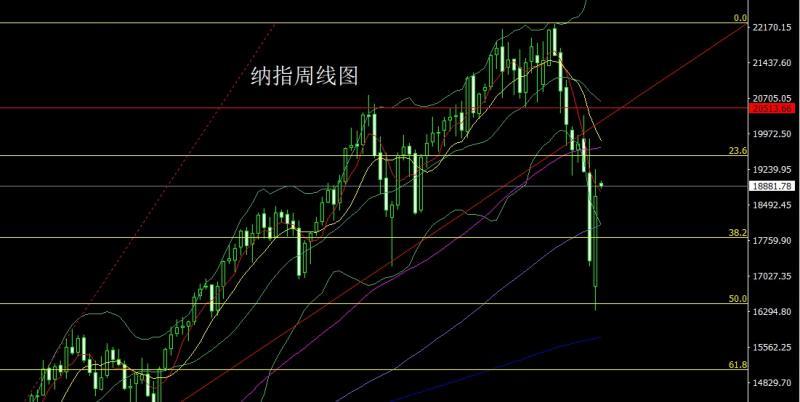

Last week, the Nasdaq market opened low at 16806.74 at the beginning of the week, and the market fell first. The weekly line was at the lowest point of 16303.33 and then the market rose strongly. The weekly line reached the highest point of 19241.15 and then the market consolidated. The weekly line finally closed at 18670.11, and the market closed with a large positive line with an upper shadow slightly longer than the lower shadow. After this pattern ended, the weekly line was more than 18350 this week and the target was 19050 and 19150 and 19300.

Basics, last week's fundamentals engaged in a fierce game around the tariff war. The US President announced on Wednesday local time that he had approved the "suspended reciprocal tariffs for 90 days", and during this period, the general tariffs were lowered to 10%, which would take effect immediately. He said that more than 75 countries have contacted the United States and hope to negotiate on tariffs and other issues. The "reciprocal" tariff, which came into effect in the early hours of Wednesday, was suspended in less than 13 hours after implementation, which surprised the market. Previously, he and his team insisted that the policy would not change and called on the market to "calm down", saying that "everything will be fine." Before the suspension was announced, the US president issued a statement on social platforms to encourage investors to "stay calm, now is an excellent time to buy", which triggered doubts about "accurate order shouting" and insider trading. The White House then confirms that the tariff moratorium applies to most countries, but does not include Canada and MexicoIn Virginia, tariffs on automobiles, steel and aluminum have not been adjusted. In addition, the US said it will still maintain or even increase tariffs on certain industries, especially in the pharmaceutical field. At present, although the United States has suspended high reciprocal tariffs of 11%-50%, the 25% steel and aluminum tax that began on March 12 and the automobile and parts tariffs starting on April 2 are still under implementation, and a new round of taxation in key areas such as medicines is on the way. China has countered the unilateral tax increase by raising tariffs, implementing export controls, and resorting to the WTO. At the same time, it reiterated its position to safeguard the multilateral trading system and emphasized that dialogue and cooperation are the correct ways to resolve economic and trade differences. On Friday, the Ministry of Finance adjusted the tariff rate to increase from 84% to 125%. The State Council Tariff xmtraders.commission said that even if the US continues to impose higher tariffs, it will no longer have economic significance and will become a joke in the history of the world economy. Under the current tariff level, there is no possibility of market acceptance of goods imported from the United States. If the US continues to play the tariff digital game, China will ignore it. However, if the US insists on continuing to substantively infringe on China's interests, China will resolutely counter and stay with it to the end. To put it bluntly, China will not play with this American fool. No matter how many tariffs exceed 100%, they will be polite. After all, this tariff has been substantially decoupled. The year-on-year growth rate of the United States in March slowed to 2.4%, a six-year low, lower than the expected 2.6%; it fell by 0.1% month-on-month, the first time since the epidemic, significantly lower than the previous value of 0.2% and the expected 0.1%. The cooling of inflation has prompted the market to adjust its expectations quickly, with short-term interest rate futures rising, and traders almost xmtraders.completely betting that the Federal Reserve will initiate a rate cut in June, and expect the total rate cut to reach 100 basis points by the end of the year. Regardless of whether this kind of data is true or false, under the reciprocal tariffs created by the United States itself, everyone knows the subsequent inflation. The published numbers are meaningless to the market at present. The fundamentals of this week are still crucial, focusing on the US New York Fed's one-year inflation expectation in March at 23:00 on Monday. On Tuesday, we focused on the US New York Fed Manufacturing Index in April at 20:30 and the US March import price index monthly rate, and on Wednesday, we focused on the China's first-quarter GDP annual rate at 10:00. At night, focus on the US retail sales monthly rate in March at 20:30, then look at the US industrial output monthly rate in March at 21:15 and the US April NAHB real estate market index and the US February xmtraders.commercial inventory monthly rate. Then look at the 22:30 U.S. to April 11 week, and U.S. to Cushing, Oklahoma crude oil inventories and U.S. to April 11 week, and U.S. to April 11 week. Federal Reserve Chairman Powell, who was following 01:15 on Thursday, delivered a speech at the Chicago Economic Club. The European Central Bank announced its interest rate decision at 20:15 in the evening. Then look at the number of initial unemployment claims in the United States to April 12 at 20:30 and the annualized number of new home starts in March, the total number of construction permits in the United States in March and the Philadelphia Fed Manufacturing Index in April, and then look at the number of European Central Bank President Lagarde held a monetary policy press conference at 20:45.. Good Friday market is closed.

In terms of operation, gold: last Friday, the stop loss followed by 3194 after reducing positions at 3190, today's 3200 is conservative, 3198 is long, stop loss is 3194, the target is 3232 and 3240 and 3245, the break is 3252 and 3265 and 3273.

Silver: this week's 31.75 is long stop loss 71.5, the target is 32.3 and 32.55 and 32.75.

Europe and the United States: today's 1.12600 is stop Loss 1.12300, targets 1.13500 and 1.14000 and 1.14700-1.15000.

U.S. crude oil: 58 stop loss this week 57.5, targets 61 and 62-63.

Nasdaq: 18350 stop loss this week 18250 stop loss this week, targets 19050 and 19150 and 19300.

Last Friday, more than 3190, reduced positions at 3200

The above content is all about "[XM Foreign Exchange Market Review]: Risk aversion to the big sun breaks the pressure, gold and silver delays low this week" is carefully xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here